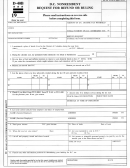

How will we respond to your request?

Who must file a Form D-40B?

• We will send you a refund for the amount you request if we

Any nonresident of DC claiming a refund of DC income tax

determine you were not a resident of DC during 2015; or

withheld or paid by estimated tax payments must file a D-40B.

A nonresident is anyone whose permanent home was outside

• Based on the information you provide, we may determine that you

DC during all of 2015 and who did not live in DC for a total of

qualify as a DC resident. If so, we will require that you file either a

183 days or more during 2015. A joint request for refund is not

DC Form D-40 or DC Form D-40EZ tax return.

permitted. Attach all statements showing DC withholding to the

Notice: In order to comply with banking rules, we will not issue a

front of page 1. Be sure to include your date of birth on page 1.

refund to or through a foreign financial institution. Instead, we will

issue a tax refund card if the refund is greater than or equal to $2.00

NOTE: If you moved into DC with the intent of residing, you are

but less than or equal to $4,000. If the refund is outside the threshold,

considered a DC resident and the 183 days does not apply.

a paper check will be issued.

In the event of a rejection of direct deposit, refunds will be re-issued on

Where to send a Form D-40B?

a paper check.

You must mail the completed Form D-40B to:

Office of Tax and Revenue

PO Box 96147

Washington, DC 20090-6147

Revised 09/2015

2015 Form D-40B P2 Nonresident Request for Refund

1

1 2

2