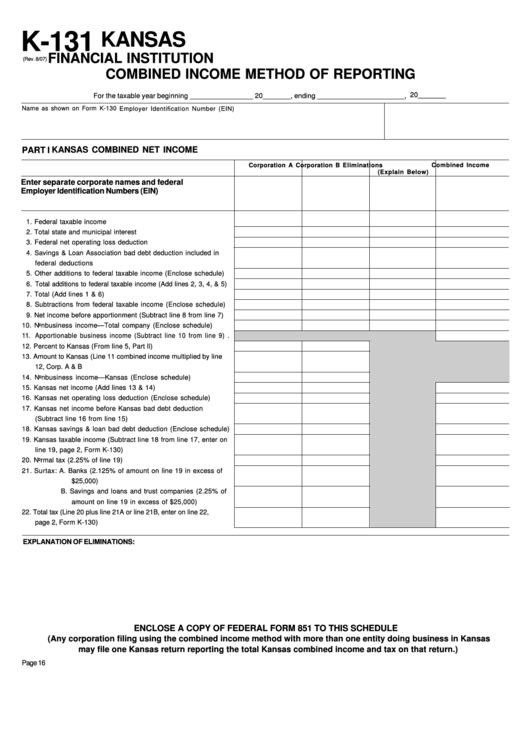

K-131

KANSAS

FINANCIAL INSTITUTION

(Rev. 8/07)

COMBINED INCOME METHOD OF REPORTING

For the taxable year beginning ________________ 20_______, ending ______________________, 20_______

Name as shown on Form K-130

Employer Identification Number (EIN)

KANSAS COMBINED NET INCOME

PART I

Corporation A

Corporation B

Eliminations

Combined Income

(Explain Below)

Enter separate corporate names and federal

Employer Identification Numbers (EIN)

1. Federal taxable income ................................................................

2. Total state and municipal interest ................................................

3. Federal net operating loss deduction ..........................................

4. Savings & Loan Association bad debt deduction included in

federal deductions ........................................................................

5. Other additions to federal taxable income (Enclose schedule)

6. Total additions to federal taxable income (Add lines 2, 3, 4, & 5)

7. Total (Add lines 1 & 6) ..................................................................

8. Subtractions from federal taxable income (Enclose schedule)

9. Net income before apportionment (Subtract line 8 from line 7)

10. Nonbusiness income—Total company (Enclose schedule) .......

11. Apportionable business income (Subtract line 10 from line 9) .

12. Percent to Kansas (From line 5, Part II) ......................................

13. Amount to Kansas (Line 11 combined income multiplied by line

12, Corp. A & B ..............................................................................

14. Nonbusiness income—Kansas (Enclose schedule) ..................

15. Kansas net income (Add lines 13 & 14) .....................................

16. Kansas net operating loss deduction (Enclose schedule) ........

17. Kansas net income before Kansas bad debt deduction

(Subtract line 16 from line 15) .....................................................

18. Kansas savings & loan bad debt deduction (Enclose schedule)

19. Kansas taxable income (Subtract line 18 from line 17, enter on

line 19, page 2, Form K-130) ........................................................

20. Normal tax (2.25% of line 19) ......................................................

21. Surtax: A. Banks (2.125% of amount on line 19 in excess of

$25,000) ....................................................................

B. Savings and loans and trust companies (2.25% of

amount on line 19 in excess of $25,000) ................

22. Total tax (Line 20 plus line 21A or line 21B, enter on line 22,

page 2, Form K-130) .....................................................................

EXPLANATION OF ELIMINATIONS:

ENCLOSE A COPY OF FEDERAL FORM 851 TO THIS SCHEDULE

(Any corporation filing using the combined income method with more than one entity doing business in Kansas

may file one Kansas return reporting the total Kansas combined income and tax on that return.)

Page 16

1

1 2

2