STATE OF CALIFORNIA

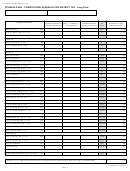

BOE-401-E (S2F) REV. 95 (4-13)

BOARD OF EQUALIZATION

State, Local, and District Consumer Use Tax Return Instructions

(Please refer to publication 79-B,

California Use Tax,

for additional information about reporting the use tax.)

This return should be filed by persons who are not required to

Enter the

1. Teleproduction Equipment Exemption:

hold a seller's permit but who are liable for state, local, and

Teleproduction Equipment Exemption amount on line 1.

district use tax payable directly to the State. Holders of seller's

Complete this line to claim an exemption for purchases made

permits should file a BOE-401-A2 "State, Local, and District

by qualified persons of tangible personal property used

Sales and Use Tax Return," which may be obtained on our

primarily:

website at , or from your nearest Board of

In teleproduction or other postproduction services for film or

Equalization (BOE) office, or by writing to the Board of

video that include editing, film and video transfers,

Equalization, P.O. Box

942879,

Sacramento, California

transcoding, dubbing, subtitling, credits, close captioning,

94279-0001. If you use property in two or more counties, you

audio production, special effects (visual or sound), graphics,

must attach a schedule showing the purchase price of the

or animation, or

property and where it was used. You can use your own

With respect to property with a useful life of at least one year,

schedule or you can call our Information Center for our

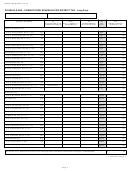

BOE-531-X, Schedule X - Detailed Allocation by County of

to maintain, repair, measure, or test property used primarily in

teleproduction or other postproduction services.

Sales Exempt From Combined State and Uniform Local Tax.

You owe use tax when you purchase or lease an item from a

A qualified person is a business that is primarily engaged in

retailer who is not engaged in business in California and who is

providing

the

specialized

motion

picture

or

video

not registered to collect the California Use Tax. You do not owe

postproduction services described above.

use tax if you have a receipt showing the tax was paid to a

This exemption does not apply to the sale or use of any

retailer authorized by the BOE to collect the use tax. Use tax is

tangible

personal

property

that

is

used

primarily

in

due on items rented or leased, and on items stored, used, or

administration, general management, or marketing (used 50

consumed in California.

percent or more of the time in one or more of those activities).

You do not owe use tax if:

2. Farm Equipment and Machinery Exemption:

a California sales tax was paid at the time an item was

Enter the Farm Equipment Exemption amount on line 2.

purchased, or

Complete this line to claim a partial exemption for qualified

b you pay rent on an item for which sales or use tax has been

sales and purchases of qualified farm equipment, machinery

paid by the lessor on their purchase price. This applies as

and their parts. It also applies to qualified lease payments for

long as the item has not been substantially modified, or

farm equipment and machinery paid on or after September 1,

2001.

c the item is specifically exempt from tax, such as food

products

for

human

consumption.

For

additional

3. Diesel Fuel Used in Farming and Food Processing

information on exemptions, see Parts 1, 1.5, and 1.6 of

Exemption:

Division 2 of the Revenue and Taxation Code.

Enter the Diesel Fuel Exemption for Farming & Food Processing

amount on line 3. Complete this line to claim a partial

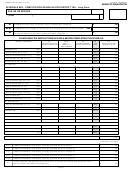

TOP OF PAGE 1

exemption for qualified sales and purchases of diesel fuel used

Note: If you received a return in the mail begin your instructions

in farming activities or food processing. The diesel fuel must be

on Line 1 below.

consumed during the activities of a farming business as set

Select the tax period by clicking on the drop-down arrow and

forth in Internal Revenue Code (IRC) 263A. Qualifying diesel

choose from the periods listed, then enter the year.

fuel may be used in either a motor vehicle or other equipment,

such as generators.

If you have an Account number enter it in the space provided. if

you are a "one-time filer," check the box provided.

4. Timber Harvesting Machinery and Equipment

Enter your name, personal or business address, city, state, and

Exemption:

zip code.

Enter the Timber Harvesting Equipment & Machinery Exemption

amount on line 4. Complete this line to claim a partial

To get additional information on California use tax, visit our

exemption for qualified sales and purchases of Timber

website at /taxprograms/usetax/index.htm .

Harvesting Equipment and Machinery.

5. Racehorse Breeding Stock Exemption:

Line 1. CONSUMER USE TAX

Enter the Racehorse Breeding Stock amount on line 5.

Enter the total purchase price of items subject to use tax.

Complete this line to claim a partial exemption for qualified

Line 2. ADJUSTED PARTIAL STATE TAX EXEMPTIONS

sales and purchases of Racehorse Breeding Stock. Racehorse

You must complete the adjusted partial state tax exemption on

Breeding Stock means racehorses capable of and purchased

the back of your return to claim these deductions.

solely for the purpose of breeding.

(Continued on the back)

1

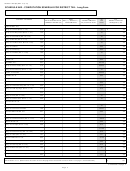

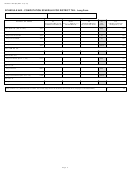

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10