PPT PCF

Instructions for Completing Application

Rev. 9/05

Page 3

(Failure to properly complete an application will result in the denial of the issuance of a certificate.)

1.a. Check the appropriate space for the type of exempt facility

10.b. If the facility is completed, list the completion date of the

you are requesting (Air, Noise or Water Pollution Control).

facility. If not completed, indicate the estimated completion

Unless line 1.b. of the instructions applies, a separate

date.

application must be filed for each exempt facility. This

10.c. Enter the date that construction of the facility began. If

application cannot be used for an application related to the

construction has not started, indicate the estimated start

expansion, addition or replacement of property for an existing

date.

certificate or to transfer a certificate to a new owner.

10.d. Air, noise or water pollution control facilities require Ohio

1.b. If the application is for substantially similar facilities located

EPA permits. Provide your permit number(s).

in the same county and by the same owner(s), you may

initially file one application for all those facilities. This

11.

You must include the following documents and/or

department will notify you if it is required to file separate

information as attachments for the application to be

applications for each facility in the county.

considered complete (if multiple facilities in the same county

are claimed you must note any differences in the facilities):

2.

Check the appropriate space to indicate the type of

ownership. If this facility is jointly owned, check “Joint.” File

11.a. Provide a copy of the plans, specifications and

only one application for all the owners of a facility.

drawings of the facility for which an exempt facility

certificate is requested.

3.

Print the name of the owner of the facility. If the facility for

which the application is requested is jointly owned or owned

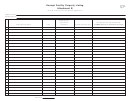

11.b. Complete the Exempt Facility Property Listing labeled

by a partnership, you must list the names of all the owners

as “Attachment B.” All components incorporated in or

along with their respective percentage of ownership. If

to be incorporated in the facility, along with the cost of

needed, attach a list to this application.

those components, must be listed.

If auxiliary

property is claimed, you must clearly indicate the

4.

Print the mailing address of all the owner(s) of the facility. If

basis and your calculation for how you determined

needed, attach a list to this application. Note: This is the

the tax-exempt cost for the auxiliary property.

location where the issuance, or denial, of a certificate will

be mailed.

11.c. Provide a narrative statement that succinctly explains

the purpose and operations of the facility. You must

5.a. Enter the owner(s) federal employer identification number

report the operations of the facility that are both subject

(FEIN). If you are a sole proprietor and you do not have an

to a tax exemption and those operations that are not.

FEIN, you must use your social security number. If needed,

attacha list to this application.

12.

The initial application fee is ½% of the exempt facility cost

listed on line 9.a., not to exceed $2,000. The fee is not

5.b. Enter the owner(s) Ohio charter number (incorporated in

refundable. Only checks and money orders payable to the

Ohio) or license number (doing business in Ohio). If needed,

Ohio Treasurer of State are acceptable (no cash). The fee

attach a list.

may increase if the costs are higher than reported.

6.

Print the name of the facility. If needed, attach a list to this

13.

Print the name and e-mail address of the primary contact

application if this is for more than one similar facility in the

person. Note: This is the person that will be sent notice

same county.

for any additional information that is needed to have a

7.

Print the physical address of the facility. The physical

complete application and should be the person that is able

address is needed for inspection purposes. If needed, attach

to explain any questions regarding this application to this

a list to this application if this is for more than one similar

department or the Ohio EPA. If not by an employee of the

facility in the same county.

owner of the facility, a TBOR-1 is required.

8.

List the taxing district, township, school district and county

14.

Print the mailing address for the primary contact person.

where the facility is located. If needed, attach a list to this

15.

Print the telephone number and fax number of the primary

application if this is for more than one similar facility in the

contact person. If applicable, you may provide an additional

same county.

number.

9.a. Provide the total exempt facility cost. This includes costs

16.

Check the appropriate space if you want to claim the cost

that will be taxable and nontaxable if a certificate is issued.

reported on line 9.b. as exempt for certain taxes. While you

9.b. Provide the facility cost that only includes the portion of costs

may be able to file a refund claim, final assessment or tax

for which the applicant seeks a tax exemption. Note: This is

appeal for property claimed as exempt prior to filing this

the amount that this department is required to report to

application, you cannot apply such exemption to any period

the appropriate county auditor(s).

of time that is otherwise closed by operation of law (statute

of limitations).

9.c. Check the appropriate space to indicate if the costs for 9.a.

and 9.b. are actual or estimated.

17.

Provide the authorized signature of the person responsible

for filing this application. If not by an employee of the owner

10.a. Check the appropriate space to indicate whether the facility

of the facility, a TBOR-1 is required.

is completed, under construction or in the planning stage.

Note: If this facility is not completed, you must contact

18.

Print the name, title and phone number of the authorized

this department when the facility is completed because

person signing this application.

(absent special circumstances) the application will not

be forwarded to the Ohio EPA until the facility is

constructed and operational.

In order to expedite the processing of your application, please submit in triplicate the application and

all accompanying documentation (along with applicable fee) to: Office of Chief Counsel,

Tax Appeals Division, P.O. Box 530, Columbus, OH 43216-0530. Phone: (614) 466-6750.

1

1 2

2 3

3