Instructions for the Nonresident Military Spouse Earned Income Deduction

Based on provisions within the Military Spouse Residency Relief

Line 3 – Add lines 1 and 2 and enter the total here. This is your

Act of 2009 (Public Law No. 111-97), a spouse of a nonresident

deduction. Enter this amount on Indiana Schedule C: Deductions,

military servicemember may not owe tax to Indiana on earned

under line 11. Identify this deduction by using the 3-digit code

income from Indiana sources.

number 625.

Important: If any of the conditions above change, you will no

The spouse may claim Indiana-source earned income* as a

deduction if:

longer be eligible for the deduction of Indiana-source earned

•

Indiana is not the military servicemember’s state of domicile

income. Only the income earned up to the time the condition

as reported on the servicemember’s Form DD-2058;

changed will be exempt.

•

The military servicemember and spouse are domiciliaries of

the same state;

Example. Mary was assigned to a post overseas, and left Indiana

•

The military servicemember is in Indiana on military orders;

on October 1; Tom remained in Indiana. $24,000 of Tom’s $32,000

•

The military servicemember’s spouse is in Indiana in order

total wage income was earned before October 1. His deduction is

to live with the servicemember, and resides at the same

limited to $24,000.

address; or

•

The military servicemember and spouse live together in a

Part 2: Additional Information

state other than Indiana, but the servicemember’s spouse

Line 1 – Enter the 2-letter code of the spouse’s state of domicile in

works in Indiana; and

the box.

•

The Indiana-source income is included on Indiana Schedule

A on line 1B, 2B and/or 7B.

Example. Tom should enter KS for Kansas.

*Earned income for purposes of this deduction includes:

Line 2 – Tell us if you are including the Indiana-source earned

•

Wages, salaries, tips and other compensation from Indiana

income on your state of domicile’s tax return.

sources, and/or

•

Income from a sole proprietorship (reported on federal

Example. Tom and Mary are domiciliaries of Kansas. They filed a

Schedule C or C-EZ) from Indiana sources.

tax return with Kansas, and included the Indiana-source income

on the tax return. Tom should check the Yes box.

Important: You must enclose a copy of the military servicemem-

ber’s W-2 when claiming this deduction.

Note: If you answered No or N/A to the question on line 2, include

an explanation.

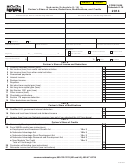

Part 1: Figure your deduction

Line 1 – Enter the amount of the military servicemember’s

Final thoughts

spouse’s Indiana-source earned wages, salaries, tips and other

Remember, you must enclose a copy of the military servicemem-

compensation reported on Schedule A, line 1B or line 2B. DO

ber’s W-2 when claiming this deduction. Otherwise, the deduction

NOT include any servicemember’s income reported on these

will be denied.

lines.

Get Information Bulletin #27 at for

Example. Mary is a military servicemember. She is stationed

additional information.

in Indiana, and her husband Tom resides with her in Indiana.

Her state of domicile on Form DD-2058 is Kansas. Tom’s state

of domicile is also Kansas. Tom meets the requirements to be

eligible to claim this deduction. He earned $32,000 wage income

while working in Indiana during the year, and included that income

on Schedule A, Line 1B. He should enter $32,000 on line 1.

Line 2 – Enter the amount of the military servicemember’s

spouse’s Indiana-source sole proprietorship income reported on

Schedule A, line 7B. DO NOT include any servicemember’s sole

proprietorship income included on line 7B.

Example. The same set of circumstances as the example above,

except Tom has $27,000 sole proprietorship income from Indiana

sources, and no wage income. He reported the $27,000 income

on Schedule A, line 7B. Mary did not have any sole proprietor

income. Tom should enter $27,000 on lines 2a and 2b.

*24100000000*

24100000000

1

1 2

2