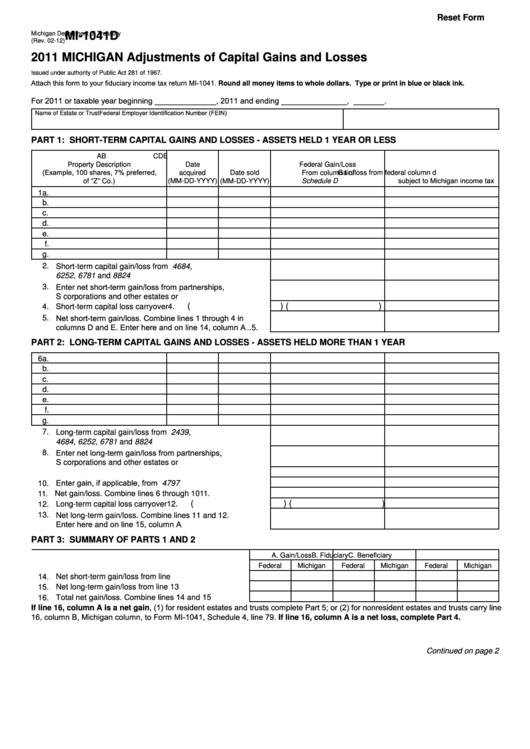

Reset Form

Michigan Department of Treasury

MI-1041D

(Rev. 02-12)

2011 MICHIGAN Adjustments of Capital Gains and Losses

Issued under authority of Public Act 281 of 1967.

Attach this form to your fiduciary income tax return MI-1041. Round all money items to whole dollars. Type or print in blue or black ink.

For 2011 or taxable year beginning ______________, 2011 and ending _______________, _______.

Federal Employer Identification Number (FEIN)

Name of Estate or Trust

PART 1: SHORT-TERM CAPITAL GAINS AND LOSSES - ASSETS HELD 1 YEAR OR LESS

A

B

C

D

E

Property Description

Date

Federal Gain/Loss

(Example, 100 shares, 7% preferred,

acquired

Date sold

From column f of

Gain/loss from federal column d

subject to Michigan income tax

of “Z” Co.)

(MM-DD-YYYY)

(MM-DD-YYYY)

U.S. Schedule D

1a.

b.

c.

d.

e.

f.

g.

2. Short-term capital gain/loss from U.S. Forms 4684,

6252, 6781 and 8824.......................................................

2.

3. Enter net short-term gain/loss from partnerships,

S corporations and other estates or trusts.......................

3.

4. Short-term capital loss carryover .....................................

4.

(

)

(

)

5. Net short-term gain/loss. Combine lines 1 through 4 in

columns D and E. Enter here and on line 14, column A ..

5.

PART 2: LONG-TERM CAPITAL GAINS AND LOSSES - ASSETS HELD MORE THAN 1 YEAR

6a.

b.

c.

d.

e.

f.

g.

7. Long-term capital gain/loss from U.S. Forms 2439,

4684, 6252, 6781 and 8824.............................................

7.

8. Enter net long-term gain/loss from partnerships,

S corporations and other estates or trusts.......................

8.

9. Capital gain distributions .................................................

9.

10. Enter gain, if applicable, from U.S. Form 4797................

10.

11. Net gain/loss. Combine lines 6 through 10 ......................

11.

(

)

(

)

12. Long-term capital loss carryover .....................................

12.

13. Net long-term gain/loss. Combine lines 11 and 12.

Enter here and on line 15, column A................................

13.

PART 3: SUMMARY OF PARTS 1 AND 2

C. Beneficiary

A. Gain/Loss

B. Fiduciary

Federal

Michigan

Federal

Michigan

Federal

Michigan

14. Net short-term gain/loss from line 5.................................

15. Net long-term gain/loss from line 13 ................................

16. Total net gain/loss. Combine lines 14 and 15 ..................

If line 16, column A is a net gain, (1) for resident estates and trusts complete Part 5; or (2) for nonresident estates and trusts carry line

16, column B, Michigan column, to Form MI-1041, Schedule 4, line 79. If line 16, column A is a net loss, complete Part 4.

Continued on page 2

1

1 2

2