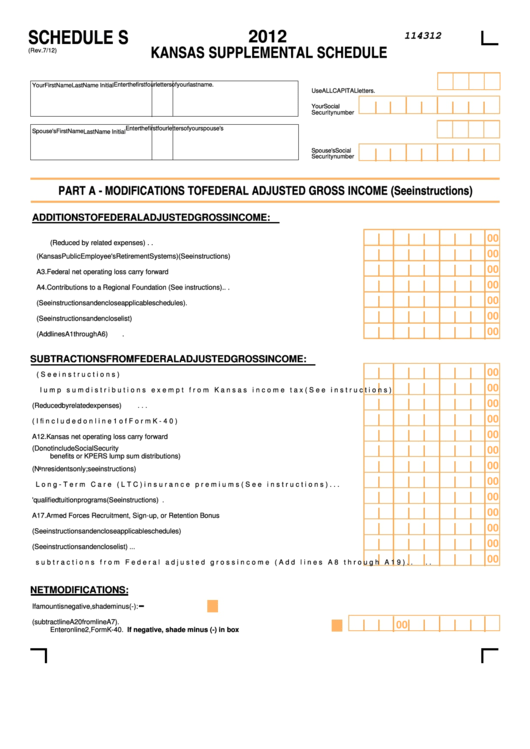

SCHEDULE S

2012

114312

KANSAS SUPPLEMENTAL SCHEDULE

(Rev. 7/12)

Enter the first four letters of your last name.

Your First Name

Initial

Last Name

Use ALL CAPITAL letters.

Your Social

Security number

Enter the first four letters of your spouse's

Spouse's First Name

Initial

Last Name

last name. Use ALL CAPITAL letters.

Spouse's Social

Security number

PART A - MODIFICATIONS TO FEDERAL ADJUSTED GROSS INCOME (See instructions)

ADDITIONS TO FEDERAL ADJUSTED GROSS INCOME:

A1. State and municipal bond interest not specifically exempt from Kansas income tax

00

(Reduced by related expenses) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

A2. Contributions to all KPERS (Kansas Public Employee's Retirement Systems) (See instructions). . . .

00

A3. Federal net operating loss carry forward. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

A4. Contributions to a Regional Foundation (See instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

A5. Kansas expensing recapture (See instructions and enclose applicable schedules). . . . . . . . . . . . . . .

00

A6. Other additions to Federal adjusted gross income (See instructions and enclose list) . . . . . . . . . . . . .

00

A7. Total additions to Federal adjusted gross income (Add lines A1 through A6). . . . . . . . . . . . . . . . . . . .

SUBTRACTIONS FROM FEDERAL ADJUSTED GROSS INCOME:

00

A8. Social Security benefits (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

A9. KPERS lump sum distributions exempt from Kansas income tax (See instructions) . . . . . . . . . . . . . .

00

A10. Interest on U.S. Government obligations (Reduced by related expenses) . . . . . . . . . . . . . . . . . . . . . .

00

A11. State or local income tax refund (If included on line 1 of Form K-40). . . . . . . . . . . . . . . . . . . . . . . . . .

00

A12. Kansas net operating loss carry forward . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

A13. Retirement benefits specifically exempt from Kansas income tax (Do not include Social Security

00

benefits or KPERS lump sum distributions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

A14. Military Compensation of a Nonresident Servicemember (Nonresidents only; see instructions) . . . . .

00

A15. Qualified Long-Term Care (LTC) insurance premiums (See instructions) . . . . . . . . . . . . . . . . . . . . . .

00

A16. Contributions to Learning Quest or other states' qualified tuition programs (See instructions) . . . . . .

00

A17. Armed Forces Recruitment, Sign-up, or Retention Bonus . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

A18. Kansas expensing deduction (See instructions and enclose applicable schedules) . . . . . . . . . . . . . .

00

A19. Other subtractions from Federal adjusted gross income (See instructions and enclose list) . . . . . . . .

00

A20. Total subtractions from Federal adjusted gross income (Add lines A8 through A19). . . . . . . . . . . . . .

NET MODIFICATIONS:

-

If amount is negative, shade minus (-) in box. Example:

-

A21. Net modifications to Federal adjusted gross income (subtract line A20 from line A7).

00

Enter on line 2, Form K-40. If negative, shade minus (-) in box. . . . . . . . . . . . . . . . . . . .

1

1 2

2