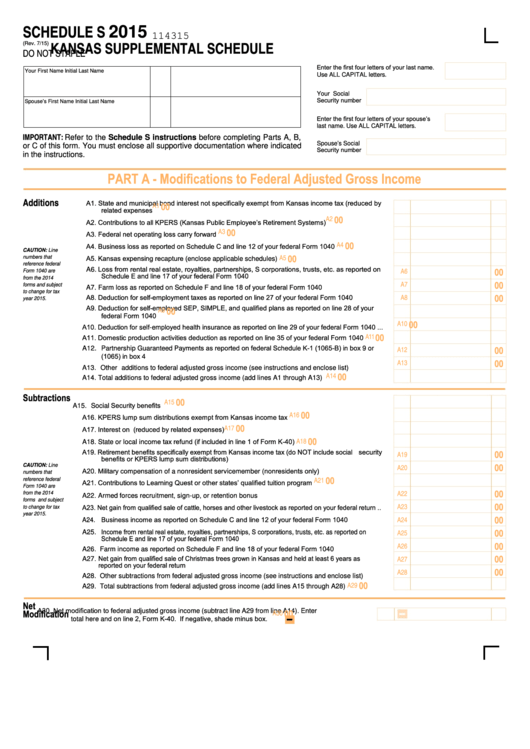

SCHEDULE S

2015

114315

KANSAS SUPPLEMENTAL SCHEDULE

(Rev. 7/15)

DO NOT STAPLE

Enter the first four letters of your last name.

Your First Name

Initial

Last Name

Use ALL CAPITAL letters.

Your Social

Security number

Spouse’s First Name

Initial

Last Name

Enter the first four letters of your spouse’s

last name. Use ALL CAPITAL letters.

IMPORTANT: Refer to the Schedule S instructions before completing Parts A, B,

Spouse’s Social

or C of this form. You must enclose all supportive documentation where indicated

Security number

in the instructions.

PART A - Modifications to Federal Adjusted Gross Income

Additions

A1. State and municipal bond interest not specifically exempt from Kansas income tax (reduced by

00

A1

related expenses ............................................................................................................................

00

A2

A2. Contributions to all KPERS (Kansas Public Employee’s Retirement Systems)..............................

00

A3

A3. Federal net operating loss carry forward .......................................................................................

00

A4

A4. Business loss as reported on Schedule C and line 12 of your federal Form 1040 ........................

CAUTION: Line

00

A5

A5. Kansas expensing recapture (enclose applicable schedules) .......................................................

numbers that

reference federal

A6. Loss from rental real estate, royalties, partnerships, S corporations, trusts, etc. as reported on

00

A6

Form 1040 are

Schedule E and line 17 of your federal Form 1040 ........................................................................

from the 2014

00

A7

forms and subject

A7. Farm loss as reported on Schedule F and line 18 of your federal Form 1040................................

to change for tax

00

A8

A8. Deduction for self-employment taxes as reported on line 27 of your federal Form 1040 ..............

year 2015.

A9. Deduction for self-employed SEP, SIMPLE, and qualified plans as reported on line 28 of your

00

A9

federal Form 1040 .........................................................................................................................

00

A10

A10. Deduction for self-employed health insurance as reported on line 29 of your federal Form 1040 ...

00

A11

A11. Domestic production activities deduction as reported on line 35 of your federal Form 1040 ........

A12. Partnership Guaranteed Payments as reported on federal Schedule K-1 (1065-B) in box 9 or

00

A12

(1065) in box 4 ...............................................................................................................................

00

A13

A13. Other additions to federal adjusted gross income (see instructions and enclose list) ...................

00

A14

A14. Total additions to federal adjusted gross income (add lines A1 through A13) ...............................

Subtractions

00

A15

A15. Social Security benefits .................................................................................................................

00

A16

A16. KPERS lump sum distributions exempt from Kansas income tax ..................................................

00

A17

A17. Interest on U.S. Government obligations (reduced by related expenses) ......................................

00

A18

A18. State or local income tax refund (if included in line 1 of Form K-40) ..............................................

00

A19. Retirement benefits specifically exempt from Kansas income tax (do NOT include social security

A19

benefits or KPERS lump sum distributions) ...................................................................................

00

A20

CAUTION: Line

A20. Military compensation of a nonresident servicemember (nonresidents only) ................................

numbers that

00

A21

reference federal

A21. Contributions to Learning Quest or other states’ qualified tuition program ....................................

Form 1040 are

00

A22

from the 2014

A22. Armed forces recruitment, sign-up, or retention bonus ..................................................................

forms and subject

00

A23

A23. Net gain from qualified sale of cattle, horses and other livestock as reported on your federal return ..

to change for tax

year 2015.

00

A24

A24. Business income as reported on Schedule C and line 12 of your federal Form 1040 ...................

00

A25. Income from rental real estate, royalties, partnerships, S corporations, trusts, etc. as reported on

A25

Schedule E and line 17 of your federal Form 1040 ...................................................................................

00

A26

A26. Farm income as reported on Schedule F and line 18 of your federal Form 1040 ..........................

00

A27. Net gain from qualified sale of Christmas trees grown in Kansas and held at least 6 years as

A27

reported on your federal return ........................................................................................................

00

A28

A28. Other subtractions from federal adjusted gross income (see instructions and enclose list) ...........

00

A29

A29. Total subtractions from federal adjusted gross income (add lines A15 through A28) .....................

Net

A30. Net modification to federal adjusted gross income (subtract line A29 from line A14). Enter

Modification

00

A30

total here and on line 2, Form K-40. If negative, shade minus

box. ...............................

1

1 2

2