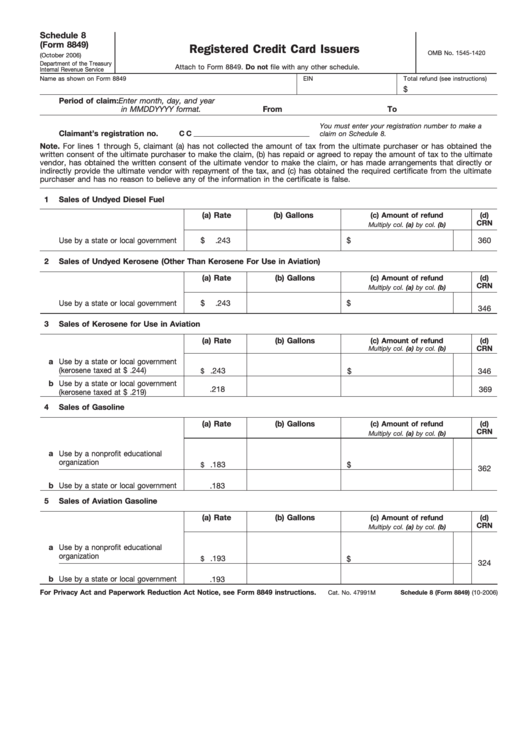

Schedule 8

(Form 8849)

Registered Credit Card Issuers

OMB No. 1545-1420

(October 2006)

Department of the Treasury

Attach to Form 8849. Do not file with any other schedule.

Internal Revenue Service

Name as shown on Form 8849

EIN

Total refund (see instructions)

$

Period of claim: Enter month, day, and year

in MMDDYYYY format.

From

To

You must enter your registration number to make a

Claimant’s registration no.

C C

claim on Schedule 8.

Note. For lines 1 through 5, claimant (a) has not collected the amount of tax from the ultimate purchaser or has obtained the

written consent of the ultimate purchaser to make the claim, (b) has repaid or agreed to repay the amount of tax to the ultimate

vendor, has obtained the written consent of the ultimate vendor to make the claim, or has made arrangements that directly or

indirectly provide the ultimate vendor with repayment of the tax, and (c) has obtained the required certificate from the ultimate

purchaser and has no reason to believe any of the information in the certificate is false.

1

Sales of Undyed Diesel Fuel

(a) Rate

(b) Gallons

(c) Amount of refund

(d)

CRN

Multiply col. (a) by col. (b)

Use by a state or local government

$

.243

$

360

2

Sales of Undyed Kerosene (Other Than Kerosene For Use in Aviation)

(a) Rate

(b) Gallons

(c) Amount of refund

(d)

CRN

Multiply col. (a) by col. (b)

Use by a state or local government

$

.243

$

346

3

Sales of Kerosene for Use in Aviation

(a) Rate

(b) Gallons

(c) Amount of refund

(d)

CRN

Multiply col. (a) by col. (b)

a

Use by a state or local government

(kerosene taxed at $ .244)

.243

$

346

$

b

Use by a state or local government

.218

369

(kerosene taxed at $ .219)

4

Sales of Gasoline

(a) Rate

(b) Gallons

(c) Amount of refund

(d)

CRN

Multiply col. (a) by col. (b)

a

Use by a nonprofit educational

organization

.183

$

$

362

b

Use by a state or local government

.183

5

Sales of Aviation Gasoline

(a) Rate

(b) Gallons

(c) Amount of refund

(d)

CRN

Multiply col. (a) by col. (b)

a

Use by a nonprofit educational

organization

.193

$

$

324

b

Use by a state or local government

.193

For Privacy Act and Paperwork Reduction Act Notice, see Form 8849 instructions.

Cat. No. 47991M

Schedule 8 (Form 8849) (10-2006)

1

1 2

2