Form LB56W Instructions

General Instructions

Penalties and Interest

Line Instructions

Line 5 — Schedule C Totals

C1. The following are considered tax-

Every licensed manufacturer or wholesaler

A 5 percent late-payment penalty will be

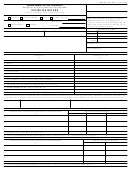

Line 1 — Beginning Inventory

exempt sales:

selling wine in Minnesota is required to

assessed on any unpaid tax for the first

Enter the number of liters for each type

collect and remit to the Department of

30 days. The penalty increases 5 percent

• Sales for shipments out of state;

of wine in columns A through F, and the

Revenue the tax from the sale of wine.

for each additional 30-day period (or any

number of bottles in column G.

• Sales to food producers or pharmaceuti-

part thereof) to a maximum of 15 percent.

Monthly filing is mandatory if your tax

cal firms used exclusively in the manu-

The beginning inventory must be the same

Returns filed after the due date will be

averages $500 or more per month.

facture of food products or medicines;

as the previous period’s ending inventory.

assessed a 5 percent late-filing penalty on

• Sales to common carriers engaged in

You must request, in writing, authorization

any unpaid tax, or $25 whichever is greater.

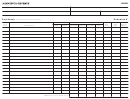

Line 2 — Schedule A Totals

interstate transportation of passengers;

to file annually or quarterly. The authoriza-

Interest will accrue on any unpaid tax and

Complete Schedule A to report the

tion remains in effect as long as the tax

penalty.

• Sales to qualified approved military

number of liters for each type of wine and

remains within the limits stated below.

clubs;

the number of bottles (exclude bottles

Payment Options

• Sales or transfers between Minnesota

• Annually filing. Tax must average less

containing less than 200ml), purchased

wholesalers;

than $100 per month.

Electronic Payments

and received during the period. Do not net

• Quarterly filing. Tax must average less

If you paid more than $10,000 in

returns to suppliers or exchanges against

• Sales to a federal agency that the state

than $500 per month.

of Minnesota is prohibited from taxing;

Minnesota excise taxes during the last

purchase. Report these as two separate

• Monthly filing. Tax must average $500

and

12-month period ending June 30, you

transactions.

or more per month.

are required to make your payments

• Sales to the established governing

Enter the total purchases in the appropriate

electronically.

body of an Indian tribe as set forth in

columns on line 2 of Form LB56W.

Due Date

M.S. 297G.08.

You must also pay electronically if you’re

Tax returns and payments must be filed

Line 3 — Schedule B Totals

required to pay any Minnesota business tax

C2. List all returns of product to suppliers.

and paid as follows:

B1. List only those customer returns on

electronically, such as sales and withholding

Report the actual returns made to a sup-

which wine tax has been paid to the state,

taxes.

Annually: File and pay by the 18th day

plier. Do not net returns against purchases.

and for which a credit memo has been

of January following the calendar year in

Go to and login

C3. List all authorized breakage and super-

issued to the customer.

which the sales were made.

to e-Services. If you don’t have Internet

vised destruction. You must attach Form

B2. List customer returns on which wine

access, call 1-800-570-3329 to pay by

Quarterly: File and pay by:

LB91, Certificate of Destruction - Wine,

tax has not been paid to the state and any

phone. You’ll need your bank routing and

• April 18 for the quarter ending March

when you file your return.

tax-exempt sales that have been returned to

account numbers. You must use an account

31;

C4. List any miscellaneous adjustments,

inventory during the period.

not associated with any foreign bank.

• July 18 for the quarter ending June 30;

corrections or transactions that decreased

• Oct. 18 for the quarter ending Sept. 30;

B3. List any miscellaneous adjustments/

Note: If you’re currently paying electronically

your inventory. If using this schedule,

and

corrections that increased your inventory

using the ACH credit method, continue to

please provide a description of the subtrac-

• Jan. 18 for the quarter ending Dec. 31.

such as samples or free goods not included

call your bank as usual. If you wish to make

tion listed.

in the purchases.

payments using the ACH credit method, visit

Monthly: File and pay by the 18th day of

Line 6 — Ending Inventory

for instructions.

the month following the month in which

The ending inventory, after performing a

the sales were made.

Paying by Check

physical inventory, should agree with, or

If the due date falls on a weekend or

If you are paying by check, complete Form

reconcile to, your ending book inventory.

holiday, returns and payments received the

PV85 and include with your payment.

This will be your next period’s beginning

next business day are considered timely.

inventory.

Note: As pursuant M.S. 297G.09, subd. 1, a

Line 14 — Audit adjustments

return must be filed regardless of whether any

List any audit adjustments or other credits

tax liability is due.

for the period.

1

1 2

2 3

3 4

4 5

5