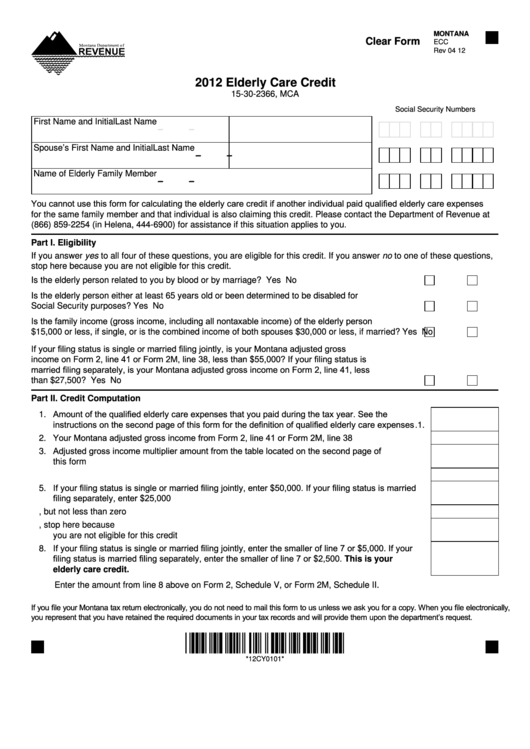

MONTANA

Clear Form

ECC

Rev 04 12

2012 Elderly Care Credit

15-30-2366, MCA

Social Security Numbers

First Name and Initial

Last Name

-

-

Spouse’s First Name and Initial

Last Name

-

-

Name of Elderly Family Member

-

-

You cannot use this form for calculating the elderly care credit if another individual paid qualified elderly care expenses

for the same family member and that individual is also claiming this credit. Please contact the Department of Revenue at

(866) 859-2254 (in Helena, 444-6900) for assistance if this situation applies to you.

Part I. Eligibility

If you answer yes to all four of these questions, you are eligible for this credit. If you answer no to one of these questions,

stop here because you are not eligible for this credit.

Is the elderly person related to you by blood or by marriage?................................................................

Yes

No

Is the elderly person either at least 65 years old or been determined to be disabled for

Social Security purposes? ......................................................................................................................

Yes

No

Is the family income (gross income, including all nontaxable income) of the elderly person

$15,000 or less, if single, or is the combined income of both spouses $30,000 or less, if married? ......

Yes

No

If your filing status is single or married filing jointly, is your Montana adjusted gross

income on Form 2, line 41 or Form 2M, line 38, less than $55,000? If your filing status is

married filing separately, is your Montana adjusted gross income on Form 2, line 41, less

than $27,500?.........................................................................................................................................

Yes

No

Part II. Credit Computation

1. Amount of the qualified elderly care expenses that you paid during the tax year. See the

instructions on the second page of this form for the definition of qualified elderly care expenses .1.

2. Your Montana adjusted gross income from Form 2, line 41 or Form 2M, line 38 ...........................2.

3. Adjusted gross income multiplier amount from the table located on the second page of

this form ..........................................................................................................................................3.

4. Multiply the amount on line 1 by the multiplier reported on line 3 above ........................................4.

5. If your filing status is single or married filing jointly, enter $50,000. If your filing status is married

filing separately, enter $25,000 .......................................................................................................5.

6. Subtract line 5 from line 2 and enter the result, but not less than zero ..........................................6.

7. Subtract line 6 from line 4 and enter the result. If the result is zero or less, stop here because

you are not eligible for this credit ....................................................................................................7.

8. If your filing status is single or married filing jointly, enter the smaller of line 7 or $5,000. If your

filing status is married filing separately, enter the smaller of line 7 or $2,500. This is your

elderly care credit. .......................................................................................................................8.

Enter the amount from line 8 above on Form 2, Schedule V, or Form 2M, Schedule II.

If you file your Montana tax return electronically, you do not need to mail this form to us unless we ask you for a copy. When you file electronically,

you represent that you have retained the required documents in your tax records and will provide them upon the department’s request.

*12CY0101*

*12CY0101*

1

1 2

2