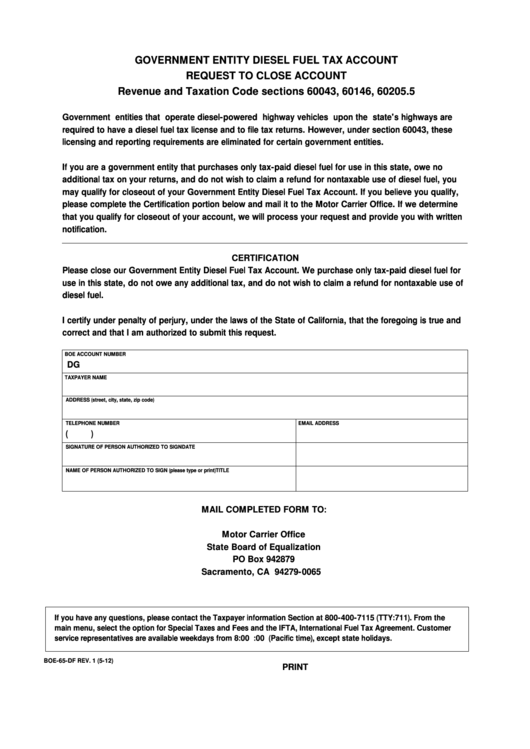

GOVERNMENT ENTITY DIESEL FUEL TAX ACCOUNT

REQUEST TO CLOSE ACCOUNT

Revenue and Taxation Code sections 60043, 60146, 60205.5

Government entities that operate diesel-powered highway vehicles upon the state's highways are

required to have a diesel fuel tax license and to file tax returns. However, under section 60043, these

licensing and reporting requirements are eliminated for certain government entities.

If you are a government entity that purchases only tax-paid diesel fuel for use in this state, owe no

additional tax on your returns, and do not wish to claim a refund for nontaxable use of diesel fuel, you

may qualify for closeout of your Government Entity Diesel Fuel Tax Account. If you believe you qualify,

please complete the Certification portion below and mail it to the Motor Carrier Office. If we determine

that you qualify for closeout of your account, we will process your request and provide you with written

notification.

CERTIFICATION

Please close our Government Entity Diesel Fuel Tax Account. We purchase only tax-paid diesel fuel for

use in this state, do not owe any additional tax, and do not wish to claim a refund for nontaxable use of

diesel fuel.

I certify under penalty of perjury, under the laws of the State of California, that the foregoing is true and

correct and that I am authorized to submit this request.

BOE ACCOUNT NUMBER

DG

TAXPAYER NAME

ADDRESS (street, city, state, zip code)

TELEPHONE NUMBER

EMAIL ADDRESS

(

)

SIGNATURE OF PERSON AUTHORIZED TO SIGN

DATE

NAME OF PERSON AUTHORIZED TO SIGN (please type or print)

TITLE

MAIL COMPLETED FORM TO:

Motor Carrier Office

State Board of Equalization

PO Box 942879

Sacramento, CA 94279-0065

If you have any questions, please contact the Taxpayer information Section at 800-400-7115 (TTY:711). From the

main menu, select the option for Special Taxes and Fees and the IFTA, International Fuel Tax Agreement. Customer

service representatives are available weekdays from 8:00 a.m. to 5:00 p.m. (Pacific time), except state holidays.

BOE-65-DF REV. 1 (5-12)

CLEAR

PRINT

1

1