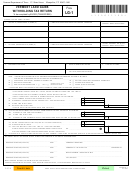

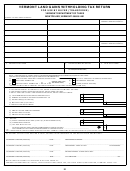

VERMONT LAND GAINS WITHHOLDING TAX RETURN (Form LG-1)

INSTRUCTIONS FOR BUYER (TRANSFEREE)

GENERAL INFORMATION

Line 4. Enter the date the seller acquired the property that is being sold.

This form is used by the buyer to report withholding of Vermont land

Line 5. Enter the month, day and year the seller transferred title to the

gains tax, which is a tax owed by the seller on the gain from the sale

land. The transfer of an option is considered a transfer of title to land. The

or exchange of Vermont land held for less than six years. The land

sale or exchange of shares in a corporation or other entity is also

gains tax is reported by the seller on Form LG-2.

considered a transfer of title to land if it effectively entitles a purchaser to

use or occupy land. In the case of a contract for deed, enter the date

If the seller is a nonresident of Vermont, the buyer is required to

consideration first passed to the seller under the contract. A mere

withhold Vermont income tax, and the Vermont Withholding Tax

promise to purchase land and amounts paid as earnest money or

Return for Transfer of Real Property (Form RW-171) must also be

amounts paid in deposit or escrow, to which the seller has no immediate

filed with the Department.

right, do not constitute the passing of consideration.

WHO IS REQUIRED TO WITHHOLD

Line 6. Enter the total sale price of land and buildings.

THE LAND GAINS TAX?

Line 7. Enter the fair market value of the land at the time of transfer. You

Anyone who purchases Vermont property that was held by the seller

may allocate gain between land and buildings using: 1) Percentages on

for less than six years is required to withhold 10% of the purchase

municipal listers card. Divide the listed value of the land plus

price of the land from the seller and remit it to the Department of Taxes

improvements (e.g.; septic system or well) by the listed value of the land,

with this return immediately after the sale. A purchaser who fails to

improvements and buildings. Multiply the result by the total sale price on

withhold or remit the tax is personally liable for the amount required to

Line 6, and enter the portion of the sale price attributable to the land on

be withheld, plus statutory interest and penalty. Exceptions to the

Line 7. Attach a separate sheet showing computation. 2) A qualified

withholding requirement are as follows:

appraisal. Attach a copy of the appraisal. 3) The percentages specified

in Technical Bulletin 34 found on our web site at

Simultaneous Filing

Alternatively, you may allocate the amount realized between building

If the buyer and seller simultaneously file this return (Form LG-1) and

and land. See Technical Bulletin 34 for more information on how to use

the Vermont Land Gains Tax Return (Form LG-2) and the seller pays

this method.

the full amount of land gains tax due, the buyer is not required to

withhold tax from the purchase price. If the seller fails to pay the full

Line 8. The buyer may claim the purchaser’s principal residence

amount of tax due, however, the buyer is liable for the deficiency, up

exemption, the builder’s exemption or the farmer’s exemption.

to 10% of the purchase price of the land.

If the buyer claims one of these exemptions, the buyer relieves the

Advance Certification

seller of any liability for the payment of the land gains tax. If the

conditions for exemption are not met, the buyer assumes liability

If the seller, in advance of the sale, has obtained a certificate from the

for the payment of the seller’s land gains tax plus statutory interest,

Commissioner of Taxes stating that the land gains tax has been paid

penalties and late filing fees. Buyer’s potential liability must be

or that no tax is due, the buyer is still required to file this return, but is

shown on Line 8. This amount may be obtained from the seller’s

not required to withhold the tax. If the seller has obtained certification

return (Form LG-2) Line 19a.

of the amount required to be withheld, the buyer is required to

withhold the amount of tax shown on the tax certificate.

Line 8a - Purchaser’s Principal Residence Exemption. Sale of a

dwelling and up to ten acres of land on which the buyer will occupy

Exemptions

within one year of purchase as a principal residence, or if no dwelling

The buyer is not required to withhold tax if the buyer or seller has a

exists on the land, land on which the buyer will construct and occupy

valid claim that the entire transaction is exempt from tax.

a principal residence within two years from purchase is exempt from

land gains tax. If local zoning requires more than ten acres for

WHO IS REQUIRED TO FILE A RETURN?

residential property, then the acreage specified in the ordinance will be

exempted, up to a maximum of 25 acres.

Anyone who purchases Vermont property that was held by the seller

for less than six years is required to file this return at the time payment

A principal residence includes a multi-family dwelling of four units or less

is made to the seller, even if no tax is required to be withheld. A

if at least one unit will be used as the buyer’s principal residence. A

withholding return is required if the buyer claims purchaser’s

dwelling may qualify as a principal residence even though the resident

principal residence exemption, builder’s exemption, agricultural

maintains an office or retail store in the dwelling. In order for a pre-

exemption, or affordable housing exemption. Exceptions to the filing

existing dwelling to qualify as a purchaser’s principal residence, the

requirement are listed on page 5 of this booklet (Line U instructions,

purchaser must become a domiciliary of Vermont and occupy the

Property Transfer Tax Return).

dwelling as his principal residence within one year of the date of

purchase.

LINE-BY-LINE INSTRUCTIONS

Line 8b - Builder’s Exemption. Sale of up to ten acres of land on which

Lines 1 and 2. Enter the full name, mailing address and social security

the buyer (a builder) will build a dwelling that will be the principal

or federal identification number of each transferor and transferee.

residence of the next purchaser is exempt from land gains tax. If local

zoning requires more than ten acres for residential property, the acreage

Line 3. Enter the street address and town where the property is located.

specified in the ordinance will be exempted, up to a maximum of 25

List all towns if more than one town is involved.

acres. The builder must begin construction of a dwelling within one year,

complete construction within two years, and sell the dwelling within three

1

1 2

2 3

3