PLEASE PRINT CLEARLY

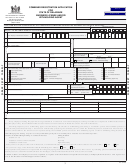

PART C - TO BE COMPLETED BY TAXPAYERS APPLYING FOR A LICENSE

LICENSE APPLICATIONS WILL NOT BE PROCESSED WITHOUT LICENSE FEE

REV CODE 0101-01

LICENSE #1 - NAME AND ADDRESS

1.

Enter Federal Employer Identification Number

OR

Social Security Number

1-

2-

2.

Name

3.

Trade Name if Different from Above

4.

Business Location Address

5.

Mailing Address if Different

City

State

Zip Code

City

State

Zip Code

FOR OFFICE USE ONLY

6.

Describe your business activity

Bus Code

Suffix

6a. Do you sell tires at retail in Delaware from this location? (For exemptions, see [10]

YES

NO

on Page 7.)

6b. Do you sell carbonated beverages at retail in Delaware from this location that are

YES

NO

consumed off-premises? (For exemptions, see [9] on Page 7.)

7.

When did or when will you begin operating in Delaware?

12 31

8.

For what calendar year are you applying? Calendar year ending

[ ] Check if 65 years or older and

Proration Basis for Initial Licenses

Jan - 100%

Apr - 75%

Jul - 50%

Oct - 25%

whose total sales are less than $10,000

Multiply Annual Fee by Respective Month

Feb - 92%

May - 67%

Aug - 42%

Nov - 17%

(25% of Annual Fee)

Percentage and Circle Month Started

Mar - 83%

Jun - 58%

Sep - 33%

Dec - 8%

PLEASE READ PART C INSTRUCTIONS BEFORE COMPLETING COMPUTATION OF THE FEE.

COMPUTATION OF FEE

$

X

= $

x

= $

Annual Fee

# of units if Applicable

Prorated Percentage

Total Fee

Total License

(annual fee X # of units)

REV CODE 0101-01

LICENSE #2 - NAME AND ADDRESS

1.

Enter Federal Employer Identification Number

OR

Social Security Number

1-

2-

2.

Name

3.

Trade Name if Different from Above

4.

Business Location Address

5.

Mailing Address if Different

City

State

Zip Code

City

State

Zip Code

FOR OFFICE USE ONLY

6.

Describe your business activity

Bus Code

Suffix

6a. Do you sell tires at retail in Delaware from this location? (For exemptions, see [10]

YES

NO

on Page 7.)

6b. Do you sell carbonated beverages at retail in Delaware from this location that are

YES

NO

consumed off-premises? (For exemptions, see [9] on Page 7.)

7.

When did or when will you begin operating in Delaware?

12 31

8.

For what calendar year are you applying? Calendar year ending

[ ] Check if 65 years or older and

Proration Basis for Initial Licenses

Jan - 100%

Apr - 75%

Jul - 50%

Oct - 25%

whose total sales are less than $10,000

Multiply Annual Fee by Respective Month

Feb - 92%

May - 67%

Aug - 42%

Nov - 17%

(25% of Annual Fee)

Percentage and Circle Month Started

Mar - 83%

Jun - 58%

Sep - 33%

Dec - 8%

PLEASE READ PART C INSTRUCTIONS BEFORE COMPLETING COMPUTATION OF THE FEE.

COMPUTATION OF FEE

X

= $

x

= $

$

Annual Fee

# of units if Applicable

Total License

Prorated Percentage

Total Fee

(annual fee X # of units)

AMOUNT DUE MUST BE REMITTED WITH THIS APPLICATION. (Total Fee from License # 1 and License # 2.)

9.

$

SIGNATURE

TITLE

DATE

I declare under penalties as provided by law that the information on this application is true, correct and complete.

4

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14