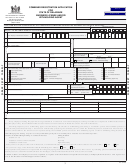

PART B - REGISTERING TO WITHHOLD DELAWARE INCOME TAXES

Delaware requires that every employer register with the Delaware Division of Revenue. Registration is

accomplished by completing this form. Delaware Withholding Agents must use the same identification number as their

Federal Employer Identification Number. Every employer required to deduct and withhold tax must file a withholding

tax return as prescribed by the statute and pay over to the Division of Revenue or its designated depository the tax

required to be deducted and withheld. An initial return is included in this application to use in filing your first return. If

you do not receive your preprinted forms in time to file your second return, call the Business Master File Unit at (302)

577-8778. If you do not have Delaware Withholding Tax Tables or need information, call the Withholding Tax Unit at

(302) 577-8779 or visit our website (see page 8). The Division of Revenue does not accept common paymasters.

Please Note: All employers are also required to register with the Department of Labor Unemployment Insurance.

For information call (302) 761-8484.

Mandatory Electronic Funds Transfer Any employer required under the provisions of §6302 of the Internal

Revenue Code to deposit federal employment taxes by electronic funds transfer will be required to deposit Delaware

withholding taxes by electronic funds transfer. The effective date for this new requirement is one year after the employer

is required to deposit the federal funds electronically. House Bill 605 imposes a penalty on employers who are required

by Delaware law but fail to deposit their withholding tax electronically. The penalty is the lesser of 5.0% of the amount

that should have been electronically transferred or $500. Employers who want to participate either as mandated under

the Internal Revenue Code requirements or voluntarily for Delaware should contact the Division of Revenue at (302)

577-8231 for additional information and the proper form.

PART C - APPLYING FOR DELAWARE BUSINESS OR OCCUPATIONAL LICENSE(S)

Enter your Federal Identification Number or Social Security Number as entered on Part A. If you are a sole

proprietor and you have a federal identification number, you must enter both numbers on Line 1.

Delaware law requires every person, firm or corporation conducting a business within this State to obtain a license

and to pay an additional monthly or quarterly fee based on the aggregate gross receipts derived from the operation of

such business. Failure to obtain a business license will result in a $200 penalty if such failure is not self disclosed. A

separate license is required for each separate business activity. You may apply for two (2) different licenses on this

application. Enter the type of license applied for and the business name and address for each separate location and/or

activity. Complete the schedule for the COMPUTATION OF FEE for each license. If you start doing business in

Delaware after February 1st, you may prorate the fees for your initial year according to the schedule, i.e., if you started

doing business in Delaware in the month of April and you are a Retailer, you are required to pay .75 x $75.00 which is

$56.25. License Fees for all new applications are proratable except Cigarette, Motor Vehicle Dealers, Circus Exhibitors

and Outdoor Musical Festival Promoters.

Decals for Cigarette, Merchandise Vending Machines and Amusement Machines are proratable upon first

application or as additional machines are purchased and placed in service.

Unless otherwise listed, the annual license fee is $75 for the first location. Occupational, Professional, General

Service, Lessors of Tangible Personal Property and Retailer's licenses require a $25 license fee for each additional

location. Farm Machinery Retailers, Food Processors, Commercial Feed Dealers, Manufacturers and Wholesalers

licenses require a $75 license for each additional location. Contractors, Motor Vehicle Dealers and Steam, Gas and

Electric licenses are not required to obtain a license for additional locations. Public utilities (gas, electric, telephone and

telegraph) are required to complete this application but are not required to obtain a business license. A complete list of

Revenue licenses is contained in this booklet titled "Detailed List of Revenue Licenses and Tax Rates". Any person 65

years of age or older whose gross receipts are less than $10,000 per year shall pay one quarter (¼) of the annual

occupational license fee specified. There is a $15.00 fee for the replacement of any lost or stolen license.

The license fee must accompany this application. Applications without the license fee will not be processed.

Most businesses are liable for a monthly or quarterly gross receipts tax at rates ranging from 0.077% to

0.576% (.00077 - .00576) in excess of allowable exclusions. Unless expressly provided in the statutes, the term "gross

receipts" is the total receipts of a business for goods sold or services rendered and no deduction is made for the cost of

goods or property sold, labor costs, interest expense, delivery costs, State or Federal taxes or any other expenses. For

additional information visit our website: Select business tax questions, then scroll down to

"Tax Tips". After you have filed your application, the Division of Revenue will mail the appropriate forms required to

report and pay the Gross Receipts Tax. An initial quarterly return is included in this application to use in filing your first

return. Please refer to the table on the next page to determine the tax rate and exclusion amount for your business

activity. If you do not receive your pre-printed forms in time to file your second return, call the Business Master File

Unit at (302) 577-8778.

5

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14