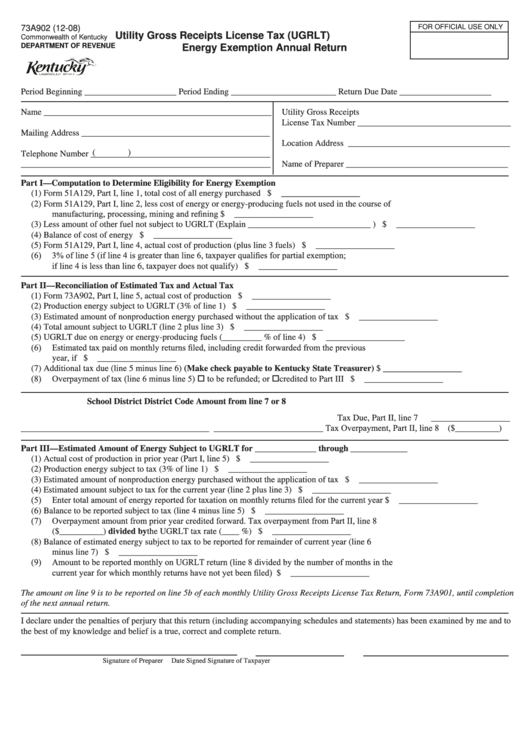

FOR OFFICIAL USE ONLY

73A902 (12-08)

Utility Gross Receipts License Tax (UGRLT)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

Energy Exemption Annual Return

Period Beginning _____________________

Period Ending ________________________

Return Due Date _____________________

Name ____________________________________________________

Utility Gross Receipts

License Tax Number ___________________________________

Mailing Address ___________________________________________

Location Address _____________________________________

(

)

Telephone Number _________________________________________

_________________________________________________________

Name of Preparer _____________________________________

Part I—Computation to Determine Eligibility for Energy Exemption

(1)

Form 51A129, Part I, line 1, total cost of all energy purchased ..................................................................

$ __________________

(2)

Form 51A129, Part I, line 2, less cost of energy or energy-producing fuels not used in the course of

manufacturing, processing, mining and refining .........................................................................................

$ __________________

(3)

Less amount of other fuel not subject to UGRLT (Explain ____________________________ ) .............

$ __________________

(4)

Balance of cost of energy ............................................................................................................................

$ __________________

(5)

Form 51A129, Part I, line 4, actual cost of production (plus line 3 fuels) ..................................................

$ __________________

(6) 3% of line 5 (if line 4 is greater than line 6, taxpayer qualifies for partial exemption;

if line 4 is less than line 6, taxpayer does not qualify) ................................................................................

$ __________________

Part II—Reconciliation of Estimated Tax and Actual Tax

(1)

Form 73A902, Part I, line 5, actual cost of production ...............................................................................

$ __________________

(2)

Production energy subject to UGRLT (3% of line 1) ..................................................................................

$ __________________

(3)

Estimated amount of nonproduction energy purchased without the application of tax ..............................

$ __________________

(4)

Total amount subject to UGRLT (line 2 plus line 3) ...................................................................................

$ __________________

(5)

UGRLT due on energy or energy-producing fuels (_________ % of line 4) ..............................................

$ __________________

(6) Estimated tax paid on monthly returns filed, including credit forwarded from the previous

year, if applicable.........................................................................................................................................

$ __________________

(7)

Additional tax due (line 5 minus line 6) (Make check payable to Kentucky State Treasurer)

$ __________________

(8) Overpayment of tax (line 6 minus line 5) to be refunded; or credited to Part III ...............................

$ __________________

School District

District Code

Amount from line 7 or 8

Tax Due, Part II, line 7

__________________

_________________________ Tax Overpayment, Part II, line 8 ($__________)

___________________________________________

Part III—Estimated Amount of Energy Subject to UGRLT for ______________ through _____________

(1)

Actual cost of production in prior year (Part I, line 5) ................................................................................

$ __________________

(2)

Production energy subject to tax (3% of line 1) ..........................................................................................

$ __________________

(3)

Estimated amount of nonproduction energy purchased without the application of tax ..............................

$ __________________

(4)

Estimated amount subject to tax for the current year (line 2 plus line 3) ....................................................

$ __________________

(5) Enter total amount of energy reported for taxation on monthly returns filed for the current year ..............

$ __________________

(6)

Balance to be reported subject to tax (line 4 minus line 5) .........................................................................

$ __________________

(7) Overpayment amount from prior year credited forward. Tax overpayment from Part II, line 8

($__________) divided by the UGRLT tax rate (____ %) .........................................................................

$ __________________

(8)

Balance of estimated energy subject to tax to be reported for remainder of current year (line 6

minus line 7) ................................................................................................................................................

$ __________________

(9) Amount to be reported monthly on UGRLT return (line 8 divided by the number of months in the

current year for which monthly returns have not yet been filed) ................................................................

$ __________________

The amount on line 9 is to be reported on line 5b of each monthly Utility Gross Receipts License Tax Return, Form 73A901, until completion

of the next annual return.

I declare under the penalties of perjury that this return (including accompanying schedules and statements) has been examined by me and to

the best of my knowledge and belief is a true, correct and complete return.

Signature of Preparer

Date Signed

Signature of Taxpayer

1

1 2

2 3

3