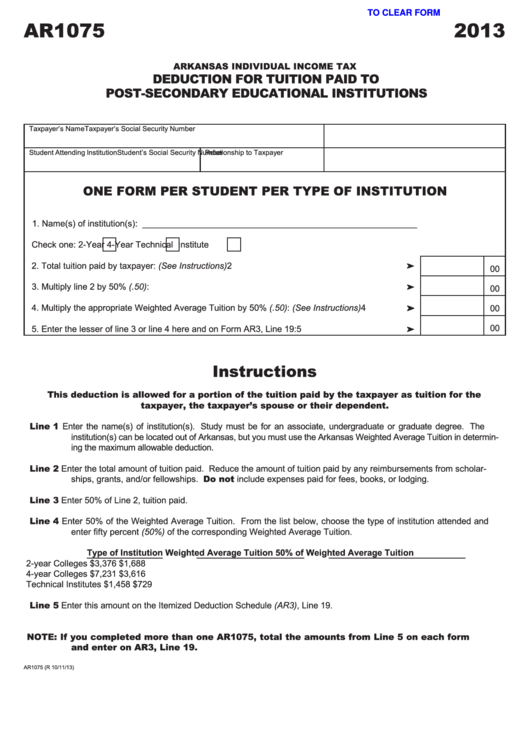

CLICK HERE TO CLEAR FORM

AR1075

2013

ARKANSAS INDIVIDUAL INCOME TAX

DEDUCTION FOR TUITION PAID TO

POST-SECONDARY EDUCATIONAL INSTITUTIONS

Taxpayer’s Name

Taxpayer’s Social Security Number

Student Attending Institution

Relationship to Taxpayer

Student’s Social Security Number

ONE FORM PER STUDENT PER TYPE OF INSTITUTION

1. Name(s) of institution(s): _________________________________________________________

Check one:

2-Year

4-Year

Technical Institute

2. Total tuition paid by taxpayer: (See Instructions) .......................................................................2

00

3. Multiply line 2 by 50% (.50): ......................................................................................................3

00

4. Multiply the appropriate Weighted Average Tuition by 50% (.50): (See Instructions) ................4

00

00

5. Enter the lesser of line 3 or line 4 here and on Form AR3, Line 19: ..........................................5

Instructions

This deduction is allowed for a portion of the tuition paid by the taxpayer as tuition for the

taxpayer, the taxpayer’s spouse or their dependent.

Line 1

Enter the name(s) of institution(s). Study must be for an associate, undergraduate or graduate degree. The

institution(s) can be located out of Arkansas, but you must use the Arkansas Weighted Average Tuition in determin-

ing the maximum allowable deduction.

Line 2

Enter the total amount of tuition paid. Reduce the amount of tuition paid by any reimbursements from scholar-

ships, grants, and/or fellowships. Do not include expenses paid for fees, books, or lodging.

Line 3

Enter 50% of Line 2, tuition paid.

Line 4

Enter 50% of the Weighted Average Tuition. From the list below, choose the type of institution attended and

enter fifty percent (50%) of the corresponding Weighted Average Tuition.

Type of Institution

Weighted Average Tuition

50% of Weighted Average Tuition

2-year Colleges

$3,376

$1,688

4-year Colleges

$7,231

$3,616

Technical Institutes

$1,458

$729

Line 5

Enter this amount on the Itemized Deduction Schedule (AR3), Line 19.

NOTE:

If you completed more than one AR1075, total the amounts from Line 5 on each form

and enter on AR3, Line 19.

AR1075 (R 10/11/13)

1

1