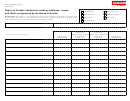

Form 4031, July/December Board of Review Affidavit Definitions

occurs only between the assessor and the taxpayer. The

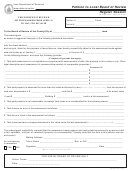

Clerical Error

mutual mistake cannot be imputed to the assessor on

International Place Apartments

an agency theory unless the assessor makes a mistake

v

in performing his/her duties in spreading and assessing

Ypsilanti Township

the tax.

1996 Mich App. 79

Homeowner’s Principal Residence

On March 29, 1996 the Michigan Court of Appeals

clarified the meaning of the term “clerical error” found

Exemption

Homeowner’s Principal Residence Exemption that was

in MCL 211.53b which authorizes the correction of a

clerical error or mutual mistake of fact by the July and

not on the Tax Roll for the current and/or previous three

December Boards of Review. The Court of Appeals

years and not denied by the Assessor, Auditing County,

states that the July and December Boards of Review

or the Department of Treasury.

are allowed to correct clerical errors of a typographical

or transpositional nature. The July and December

Reversal of a Taxable Value Uncapping Is

Boards of Review are NOT allowed to revalue or

Treated as a Clerical Error

reappraise property when the reason for the action is

P.A. 23 of 2005, MCL 211.27a (4) provides as fol-

that the assessor did not originally consider all relevant

lows:

information.

...If the taxable value of property is adjusted under

Qualified Agricultural Exemption

subsection (3) and the assessor determines that there had

The July/December Board of Review has the authority

not been a transfer of ownership, the taxable value of the

to review a denial by the Assessor of Qualified

property shall be adjusted at the July or December Board

Agricultural Property Exemptions, for the current year

of Review. Notwithstanding the limitation provided in

only.

section 53b(1) on the number of years for which a

correction may be made, the July or December Board

The July/December Board of Review has the authority

of Review may adjust the taxable value of the property

to grant a Qualified Agricultural Property Exemption

under this subsection for the current year and for the 3

that was not on the Tax Roll for the current year and the

immediately preceding calendar years. A corrected

previous year, where the property met all requirements

tax bill shall be issued for each tax year for which

for the Qualified Agricultural Property Exemptions

the taxable value is adjusted by the local tax col-

status, and where the assessor has not previously denied

lecting unit of the local tax collecting unit has pos-

the exemption.

session of the tax roll or by the county treasurer

if the county has possession of the tax roll. For

Mutual Mistake of Fact

purposes of section 53b, an adjustment under this

subsection shall be considered the correction of a cleri-

On March 31, 2010, the Michigan Supreme court

clarified the meaning of the term “mutual mistake of

cal error.

fact” found in 211.53a which authorizes the recovery

of excess payments not made under protest. The Court

Please see STC Bulletin 9 of 2005.

previously defined “mutual mistake of fact” in Ford

Motor Co v City of Woodhaven, 475 Mich 425; 716

NW2d 247 (2006) as follows: “a ‘mutual mistake of

fact’ is “an erroneous belief, which is shared and relied

on by both parties, about a material fact that affects the

substance of the transaction.” To qualify under the

statute, the “mutual mistake of fact” must be one that

1

1 2

2