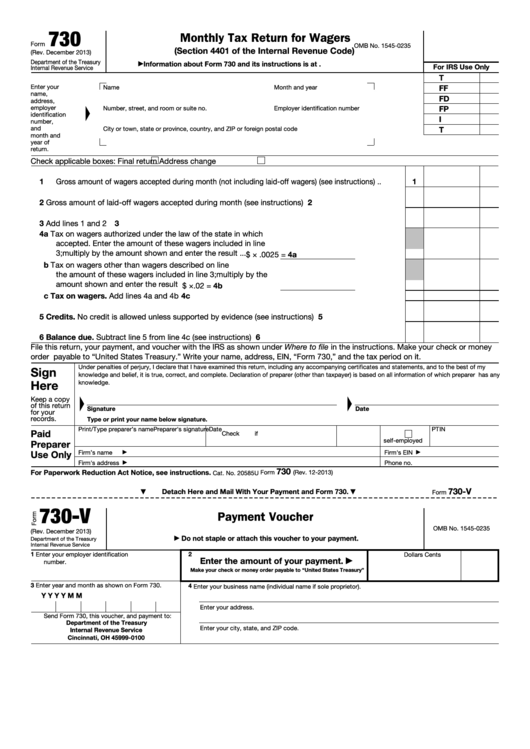

730

Monthly Tax Return for Wagers

Form

OMB No. 1545-0235

(Section 4401 of the Internal Revenue Code)

(Rev. December 2013)

Department of the Treasury

Information about Form 730 and its instructions is at

▶

For IRS Use Only

Internal Revenue Service

T

Enter your

FF

Name

Month and year

name,

FD

address,

employer

Number, street, and room or suite no.

Employer identification number

FP

identification

I

number,

and

City or town, state or province, country, and ZIP or foreign postal code

T

month and

year of

return.

Check applicable boxes:

Final return

Address change

1

1

Gross amount of wagers accepted during month (not including laid-off wagers) (see instructions)

.

.

2

Gross amount of laid-off wagers accepted during month (see instructions)

.

.

.

.

.

.

.

.

2

3

3

Add lines 1 and 2 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4a Tax on wagers authorized under the law of the state in which

accepted. Enter the amount of these wagers included in line

3; multiply by the amount shown and enter the result

.

.

. $

4a

× .0025 =

b Tax on wagers other than wagers described on line 4a. Enter

the amount of these wagers included in line 3; multiply by the

amount shown and enter the result

.

.

.

.

.

.

.

.

. $

4b

×

.02 =

c Tax on wagers. Add lines 4a and 4b .

4c

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

Credits. No credit is allowed unless supported by evidence (see instructions)

.

.

.

.

.

.

.

5

6

Balance due. Subtract line 5 from line 4c (see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

6

File this return, your payment, and voucher with the IRS as shown under Where to file in the instructions. Make your check or money

order payable to “United States Treasury.” Write your name, address, EIN, “Form 730,” and the tax period on it.

Under penalties of perjury, I declare that I have examined this return, including any accompanying certificates and statements, and to the best of my

Sign

knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any

Here

knowledge.

Keep a copy

of this return

Signature

Date

for your

records.

Type or print your name below signature.

Print/Type preparer’s name

Preparer's signature

Date

PTIN

Paid

Check

if

self-employed

Preparer

Use Only

Firm’s name

Firm's EIN

▶

▶

Firm's address

Phone no.

▶

730

For Paperwork Reduction Act Notice, see instructions.

Form

(Rev. 12-2013)

Cat. No. 20585U

730-V

Detach Here and Mail With Your Payment and Form 730.

Form

▼

▼

730-V

Payment Voucher

OMB No. 1545-0235

(Rev. December 2013)

Do not staple or attach this voucher to your payment.

Department of the Treasury

▶

Internal Revenue Service

1

Enter your employer identification

2

Dollars

Cents

Enter the amount of your payment.

▶

number.

Make your check or money order payable to “United States Treasury”

3

Enter year and month as shown on Form 730.

4

Enter your business name (individual name if sole proprietor).

Y

Y

Y

Y

M

M

Enter your address.

Send Form 730, this voucher, and payment to:

Department of the Treasury

Enter your city, state, and ZIP code.

Internal Revenue Service

Cincinnati, OH 45999-0100

1

1 2

2 3

3 4

4