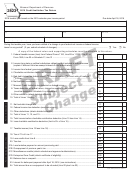

SCHEDULE A — TAXES CLAIMED AS CREDITS

DESCRIPTION (Do not list tangible personal property tax on leased property)

AMOUNT

TOTAL (Enter on Lines 8 and 19, Page 1)

ADDITIONAL INFORMATION

MUST BE COMPLETED

1. List all Missouri offices or locations for which this return is made. Indicate the complete address of each office. Include the percentage of

gross income of each office to the total income of the company in Missouri. (Attach a separate page if additional space is needed.)

2. Is this return made on the basis of actual receipts and disbursements? If not, describe fully what other basis or method was used in

computing net income.

3. State principal source of income

4. If business is a pawnbroker, state what percent of your total business is your loan business.

AUTHORIZATION

I authorize the Director of Revenue or delegate to discuss my return and attachments with the preparer or any member of his/her firm, or if internally prepared, any member of the

internal staff.

YES

NO

SIGNATURE — PLEASE SIGN BELOW

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge

and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which he/she has any knowledge. I

declare under penalties of perjury that I employ no illegal or unauthorized aliens as defined under federal law and that I am not eligible for any tax exemption,

credit or abatement if I employ such aliens. I also declare that I am a business entity, I participate in a federal work authorization program with respect to the

employees working in connection with any contracted services and I do not knowingly employ any person who is an unauthorized alien in connection with any

contracted services.

SIGNATURE OF OFFICER (REQUIRED)

TITLE OF OFFICER

PHONE NUMBER

DATE SIGNED

(__ __ __) __ __ __ ‑ __ __ __ __ __ __ / __ __ /__ __ __ __

PREPARER’S SIGNATURE (INCLUDING INTERNAL PREPARER)

PREPARER’S FEIN, SSN, OR PTIN

PHONE NUMBER

DATE SIGNED

__ __ __ __ __ __ __ __ __

(__ __ __) __ __ __ ‑ __ __ __ __

__ __ / __ __ /__ __ __ __

MAKE CHECK OR MONEY ORDER PAYABLE TO “MISSOURI DEPARTMENT OF REVENUE”. If you pay by check, you authorize the Department of Revenue to

process the check electronically. Any returned check may be presented again electronically. MAIL COMPLETED FORM AND ATTACHMENTS TO THE MISSOURI

DEPARTMENT OF REVENUE, P.O. BOX 898, JEFFERSON CITY, MO 65105‑0898.

DOR‑2823 (12‑2012)

For more information, visit

1

1 2

2