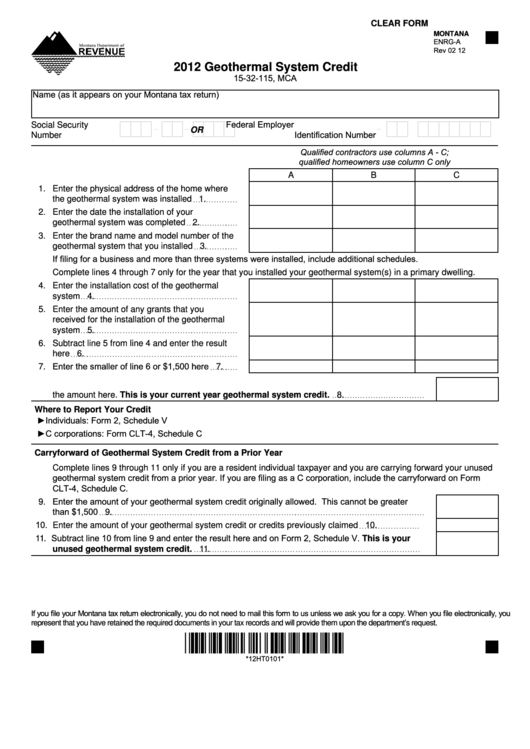

CLEAR FORM

MONTANA

ENRG-A

Rev 02 12

2012 Geothermal System Credit

15-32-115, MCA

Name (as it appears on your Montana tax return)

Federal Employer

Social Security

-

-

-

X X X X X X X X X

OR

X X X X X X X X X

Identification Number

Number

Qualified contractors use columns A - C;

qualified homeowners use column C only

A

B

C

1. Enter the physical address of the home where

the geothermal system was installed

1.

2. Enter the date the installation of your

geothermal system was completed

2.

3. Enter the brand name and model number of the

geothermal system that you installed

3.

If filing for a business and more than three systems were installed, include additional schedules.

Complete lines 4 through 7 only for the year that you installed your geothermal system(s) in a primary dwelling.

4. Enter the installation cost of the geothermal

system

4.

5. Enter the amount of any grants that you

received for the installation of the geothermal

system

5.

6. Subtract line 5 from line 4 and enter the result

here

6.

7. Enter the smaller of line 6 or $1,500 here

7.

8. Add the amounts on line 7 of each column including any amounts on additional schedules. Enter

the amount here. This is your current year geothermal system credit.

8.

Where to Report Your Credit

►Individuals: Form 2, Schedule V

►C corporations: Form CLT-4, Schedule C

Carryforward of Geothermal System Credit from a Prior Year

Complete lines 9 through 11 only if you are a resident individual taxpayer and you are carrying forward your unused

geothermal system credit from a prior year. If you are filing as a C corporation, include the carryforward on Form

CLT-4, Schedule C.

9. Enter the amount of your geothermal system credit originally allowed. This cannot be greater

than $1,500

9.

10. Enter the amount of your geothermal system credit or credits previously claimed

10.

11. Subtract line 10 from line 9 and enter the result here and on Form 2, Schedule V. This is your

unused geothermal system credit.

11.

If you file your Montana tax return electronically, you do not need to mail this form to us unless we ask you for a copy. When you file electronically, you

represent that you have retained the required documents in your tax records and will provide them upon the department’s request.

*12HT0101*

*12HT0101*

1

1 2

2