Form Eic-A - Earned Income Credit 2012

ADVERTISEMENT

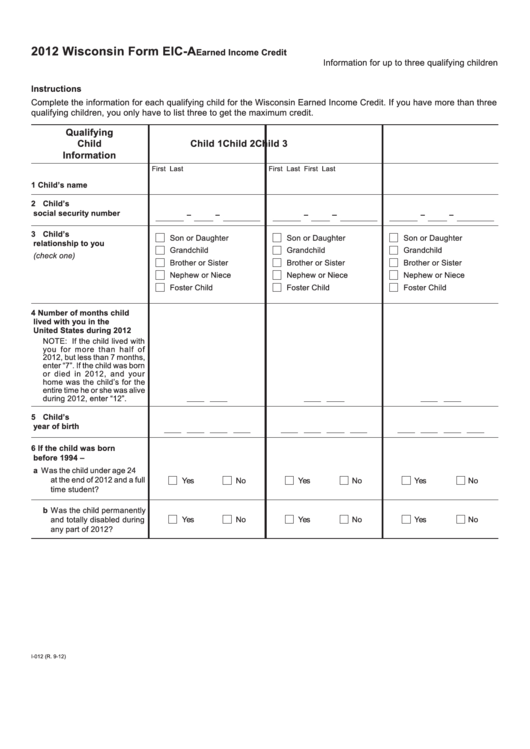

2012 Wisconsin Form EIC-A

Earned Income Credit

Information for up to three qualifying children

Instructions

Complete the information for each qualifying child for the Wisconsin Earned Income Credit. If you have more than three

qualifying children, you only have to list three to get the maximum credit.

Qualifying

Child

Child 1

Child 2

Child 3

Information

First

Last

First

Last

First

Last

1 Child’s name

2 Child’s

social security number

3 Child’s

Son or Daughter

Son or Daughter

Son or Daughter

relationship to you

Grandchild

Grandchild

Grandchild

(check one)

Brother or Sister

Brother or Sister

Brother or Sister

Nephew or Niece

Nephew or Niece

Nephew or Niece

Foster Child

Foster Child

Foster Child

4 Number of months child

lived with you in the

United States during 2012

NOTE: If the child lived with

you for more than half of

2012, but less than 7 months,

enter “7”. If the child was born

or died in 2012, and your

home was the child’s for the

entire time he or she was alive

during 2012, enter “12”.

5 Child’s

year of birth

6 If the child was born

before 1994 –

a Was the child under age 24

at the end of 2012 and a full

Yes

No

Yes

No

Yes

No

time student?

b Was the child permanently

and totally disabled during

Yes

No

Yes

No

Yes

No

any part of 2012?

I-012 (R. 9-12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1