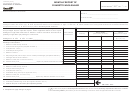

73A422 (8-13)

MONTHLY REPORT OF TOBACCO PRODUCTS, SNUFF, AND CHEWING TOBACCO

Page 2

Distributor

City

License/Account Number

For Month/Year

Part III - Chewing Tobacco

The term "chewing tobacco" means any leaf tobacco that is not intended to be smoked and includes loose leaf chewing tobacco, plug chewing tobacco, and twist chewing tobacco, but chewing tobacco

does not include snuff.

Single Units (net weight of less than 4 oz.)

17. Total sales/purchases of single units of chewing tobacco………………………….………………………………………………………………………………………………………….……………………………………………………

18. Adjustments made to single units of chewing tobacco. Attach separate sheet …………………………………………………………………………………………………………………………………………..……………………

19. Net sales/purchases of single units of chewing tobacco (line 17 plus or minus adjustments made on line 18)………………………………………………………………………………………………………………………………

20. Tax rate on single units of chewing tobacco.…………………………………………………………………………………………………………………………………………………………..….…………………………………………

x

0.19

21. Tax due on single units of chewing tobacco (multiply line 19 by line 20)……………………………………………………………………………………………………………………………….……….…………………………………

$

Half - Pound Units (net weight of at least 4 oz. but not more than 8 oz.)

22. Total sales/purchases of half - pound units of chewing tobacco…………………………………………………………………………………………………………………………………………………………………..………………

23. Adjustments made to half - pound units of chewing tobacco. Attach separate sheet ……………………………………………………………………………………………………………………………………………...……..…

24. Net sales/purchases of half - pound units of chewing tobacco (line 22 plus or minus adjustments made on line 23)…………………………………………………………………………………………………….…………………

25. Tax rate on half - pound units of chewing tobacco………..………………………………………………………………………………………………………………………………………………………...………..………………………

x

0.40

26. Tax due on half - pound units of chewing tobacco (multiply line 24 by line 25)…………………………………………………………………………………………………………………………………………………...………………

$

Pound Units (net weight of more than 8 oz. but not more than 16 oz.)

27. Total sales/purchases of pound units of chewing tobacco…………………………..…………………………………………………………………………………………...…………………………………………………………………

28. Adjustments made to pound units of chewing tobacco. Attach separate sheet ………………………………………….……………………………………………………………………………………………………………………

29. Net sales/purchases of pound units of chewing tobacco (line 27 plus or minus adjustments made on line 28)……………………………………..…………………………………………………………………….…...……………

30. Tax rate on pound units of chewing tobacco……….………………………………………………………………………………………………………………………………………………………...………………………………………

x

0.65

31. Tax due on pound units of chewing tobacco (multiply line 29 by line 30)……………………………………….........…………………………………………………………………………………………………………………………

$

Units (net weight of more than 16 oz.)

32. Net sales/purchases of units of chewing tobacco more than 16 oz., but not more than 20 oz. _________ multiplied by the tax rate of $0.84 ………………………………………………………………………………………

$

33. Net sales/purchases of units of chewing tobacco more than 20 oz., but not more than 24 oz. _________ multiplied by the tax rate of $1.03 ………………………………………………………………………………………

$

34. Net sales/purchases of units of chewing tobacco more than 24 oz., but not more than 28 oz. _________ multiplied by the tax rate of $1.22 ………………………………………………………………………………………

$

35. Net sales/purchases of units of chewing tobacco more than 28 oz., but not more than 32 oz. _________ multiplied by the tax rate of $1.41 ………………………………………………………………………………………

$

36. Net sales/purchases of units of chewing tobacco more than 32 oz. _________ multiplied by the appropriate tax rate (see instructions)………………………………………………………...

$

37. Tax due on chewing tobacco more than 16 oz. (add lines 32, 33, 34, 35 and 36)………………………………...…………......………………………………………………………………………………………………………………

$

38. Chewing tobacco tax (add lines 21, 26, 31, and 37)…………………………………….....…...……...……………………………………………………………………………………………………………………………………………

$

39. Distributor discount for timely filed reports and payment of tax (multiply line 38 by .01)…………………………………………………………………………………………………………………………………………………………

$

40. Total chewing tobacco tax due (line 38 minus line 39) (enter here and on page 1, line 15)………………………………………………………………………………………….………….………………………………………………

$

1

1 2

2 3

3