4404, Page 2

Instructions for Form 4404, Refund Request for Motor Fuel End Users

Note: End Users include anyone who purchases qualifying fuel for consumption, and maintains storage of the fuel.

This refund request is made available as a result of Public Act 268 (PA 206) of 2006, which takes effect September 1,

2006. PA 206 reduces the motor fuel excise tax on gasoline-ethanol blends that contain at least 70% ethanol to twelve

cents per gallon. PA 206 also reduces the motor fuel excise tax on biodiesel, and petroleum diesel-biodiesel blends that

contain at least 5% biodiesel to twelve cents per gallon. To collect a refund on qualifying fuel in storage at the close of

business on August 31, 2006, this refund request must be postmarked in our office by November 29, 2006.

Gasoline includes ethanol. DO NOT INCLUDE DYED DIESEL FUEL PRODUCTS OR 100% ETHANOL. Copies of

invoices must be submitted with this form to qualify for the refund.

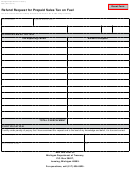

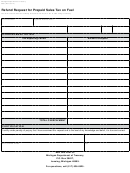

TAXPAYER INFORMATION. If your report is pre-identified, cross out any incorrect information and enter the correct

information, otherwise enter company name, FEIN, contact person name, telephone and fax numbers, and email address

of the person we may contact concerning this report.

Line 1: Enter the total gallons of qualified fuel products in storage at the close of business on August 31, 2006. DO NOT

INCLUDE DYED DIESEL FUEL PRODUCTS OR 100% ETHANOL. Copies of invoices MUST be submitted.

Line 2: End users must deduct 3,000 gallons.

Line 3: Refundable Gallons: Subtract line 2 from line 1. If less than zero, enter 0 and do not proceed.

Line 4: Refund Rate.

Line 5: Refund Amount. Multiply line 3 by line 4.

Your refund request must be postmarked by November 29, 2006. Late requests are not eligible for refund.

MAIL YOUR REFUND REQUEST TO:

Michigan Department of Treasury

Special Taxes Division

P.O. Box 30474

Lansing, MI 48909-8209

If you have any questions, call the Special Taxes Division at (517) 636-4600.

1

1 2

2