Form Dmf-80 - Reimbursement Request For Motor Fuel Taxes Paid On Sales To Government/exempt Entities

ADVERTISEMENT

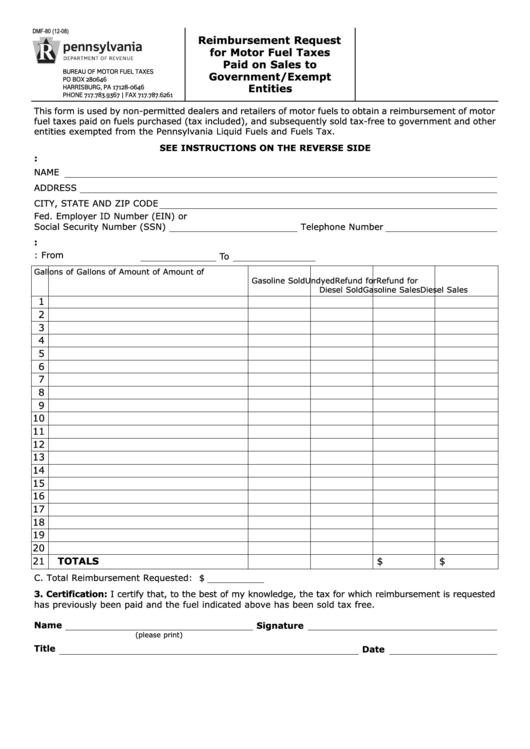

DMF-80 (12-08)

Reimbursement Request

for Motor Fuel Taxes

Paid on Sales to

BUREAU OF MOTOR FUEL TAXES

Government/Exempt

PO BOX 280646

HARRISBURG, PA 17128-0646

Entities

PHONE 717.783.9367 | FAX 717.787.6261

This form is used by non-permitted dealers and retailers of motor fuels to obtain a reimbursement of motor

fuel taxes paid on fuels purchased (tax included), and subsequently sold tax-free to government and other

entities exempted from the Pennsylvania Liquid Fuels and Fuels Tax.

SEE INSTRUCTIONS ON THE REVERSE SIDE

1. Applicant Information:

NAME

ADDRESS

CITY, STATE AND ZIP CODE

Fed. Employer ID Number (EIN) or

Social Security Number (SSN)

Telephone Number

2. Reimbursement Information:

A. Refund Period: From

To

Gallons of

Gallons of

Amount of

Amount of

B.

Name of Exempt Entity

Gasoline Sold

Undyed

Refund for

Refund for

Diesel Sold

Gasoline Sales

Diesel Sales

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

TOTALS

$

$

C. Total Reimbursement Requested: $

3. Certification: I certify that, to the best of my knowledge, the tax for which reimbursement is requested

has previously been paid and the fuel indicated above has been sold tax free.

Name

Signature

(please print)

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2