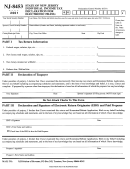

State of New Mexico Taxation and Revenue Department

ACD-31012 (2014)

Rev. 11/10/2014

INDIVIDUAL INCOME TAX DECLARATION FOR

PIT-8453

ELECTRONIC FILING AND TRANSMITTAL

2014

For the year January 1 - December 31, 2014

INSTRUCTIONS

Page 1 of 2

authorizes a tax preparer or other third party to electronically

Who Must Complete this Form

transmit (file) the tax return on behalf of the taxpayer and

Form 2014 PIT-8453 must be completed when a tax preparer,

electronic return originator (ERO), or other third-party trans-

authenticates the electronic portion of the return.

mitter electronically transmits a 2014 New Mexico Personal

After Form PIT-8453 has been completed and signed, paid tax

Income Tax (PIT-1) return to the Department.

preparers and other third-party transmitters must provide the

IMPORTANT: Form 2014 PIT-8453 must also be completed by

taxpayer a copy of the prepared return and Form PIT-8453.

individuals who electronically transmit (file) their own returns,

The electronic return transmitter must advise the taxpayer of

the taxpayer's responsibility for keeping all documentation

but only when supporting documentation is required to

related to the tax filing for 10 years from the end of the cal-

be submitted to the Department in paper form.

endar year when the return was due or filed. The electronic

Form PIT-8453 can only be submitted to the Department in

return transmitter also must retain Form PIT-8453 and all

paper format. See Who Must Submit This Form to the Depart-

supporting documents for a period of three years from the

ment (below), for further details.

end of the calendar year when the return was due or filed.

Taxpayers who submit 2014 personal income tax returns

How to Complete this Form

through the Federal/State e-file program (a third-party software

Complete the taxpayer name(s), address, social security

program) may now be able to attach or include supporting

number(s), residency status, and filing status information as

documentation with the electronic file. If all supporting docu-

reported on Form PIT-1. Mark the residency status box for

ments are submitted with the electronic file, Form PIT-8453

the primary taxpayer and the spouse exactly as it is marked

is not required to be submitted to the Department.

on PIT-1 return, with R for resident, N for non-resident, P for

part-year resident, and F for first-year resident.

Who Must Submit this Form to the Department

Generally, Form PIT-8453 is not required to be submitted to

PART I Tax Return Information. Complete lines 1 through

the Department. Form PIT-8453 is only required to be submit-

5 with the information from the taxpayer's return data. The

ted to the Department if the electronically filed return requires

numbers on these lines must match the entries on the cor-

supporting forms, schedules, and other paper documentation

responding lines of the electronic return.

required to support the return data, exemptions, deductions,

or credits, and the supporting documentation is not attached

PART II Declaration of Taxpayer. The taxpayer and spouse,

or included with the electronically filed return. See the list of

if married filing separately, must sign PART II authorizing

supporting documentation on page 2 of these instructions.

the electronic transmission of their return and declaring

that the taxpayer information provided on Form PIT-8453 is

Do not submit copies of Form PIT-1 or Schedules PIT-S, PIT-

true, correct, and complete. A blank Form PIT-8453 must be

ADJ, PIT-RC, PIT-B, PIT-D, or PIT-CR. You are required to

treated the same as a blank tax return in that a tax preparer,

submit Form PIT-8453 only if you have one or more supporting

electronic return originator, or other third-party transmitter

documents that are not electronically submitted with the return.

must not allow any taxpayer to sign a blank Form PIT-8453

Individuals electronically filing their own return through the

or tax return. The taxpayer may review the completed tax

New Mexico WebFile application are instructed by the pro-

return on a display terminal.

gram when required to complete and submit Form PIT-8453.

PART III Declaration of Preparer/Transmitter. The tax

Special Instructions for a Paid Tax Preparer, Electronic

preparer, electronic return originator, or other third-party

Return Originator, or Other Third-Party Transmitter

transmitter must complete PART III. Individuals who elec-

When a 2014 New Mexico personal income tax return is elec-

tronically transmitted their own returns leave Part III blank.

tronically transmitted through a paid tax preparer, electronic

If a person other than the transmitter prepares the return,

return originator, or other third-party transmitter, the tax pre-

the paid preparer's signature is also required. Instead of

parer or transmitter must complete Form PIT-8453 and obtain

obtaining the paid preparer's signature on the PIT-8453,

a signature(s) from the taxpayer(s), even if the form is not

the ERO may attach to Form PIT-8453 a copy of the return

required to be submitted to the Department. Form PIT-8453

bearing the paid preparer's signature.

1

1 2

2 3

3