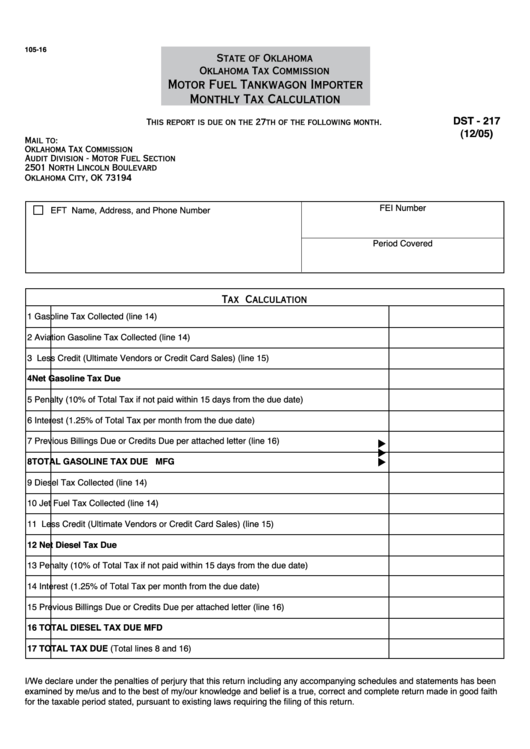

Form 105-16 - Motor Fuel Tankwagon Importer Monthly Tax Calculation

ADVERTISEMENT

105-16

State of Oklahoma

Oklahoma Tax Commission

Motor Fuel Tankwagon Importer

Monthly Tax Calculation

DST - 217

This report is due on the 27th of the following month.

(12/05)

Mail to:

Oklahoma Tax Commission

Audit Division - Motor Fuel Section

2501 North Lincoln Boulevard

Oklahoma City, OK 73194

FEI Number

EFT

Name, Address, and Phone Number

Period Covered

Tax Calculation

1

Gasoline Tax Collected (line 14)

2

Aviation Gasoline Tax Collected (line 14)

3

Less Credit (Ultimate Vendors or Credit Card Sales) (line 15)

4

Net Gasoline Tax Due

5

Penalty (10% of Total Tax if not paid within 15 days from the due date)

6

Interest (1.25% of Total Tax per month from the due date)

7

Previous Billings Due or Credits Due per attached letter (line 16)

8

TOTAL GASOLINE TAX DUE

MFG

9

Diesel Tax Collected (line 14)

10

Jet Fuel Tax Collected (line 14)

11

Less Credit (Ultimate Vendors or Credit Card Sales) (line 15)

12

Net Diesel Tax Due

13

Penalty (10% of Total Tax if not paid within 15 days from the due date)

14

Interest (1.25% of Total Tax per month from the due date)

15

Previous Billings Due or Credits Due per attached letter (line 16)

16

TOTAL DIESEL TAX DUE

MFD

17

TOTAL TAX DUE (Total lines 8 and 16)

I/We declare under the penalties of perjury that this return including any accompanying schedules and statements has been

examined by me/us and to the best of my/our knowledge and belief is a true, correct and complete return made in good faith

for the taxable period stated, pursuant to existing laws requiring the filing of this return.

Official Title

Signature

The Oklahoma Tax Commission is not required to notify taxpayer of any change in state tax law

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2