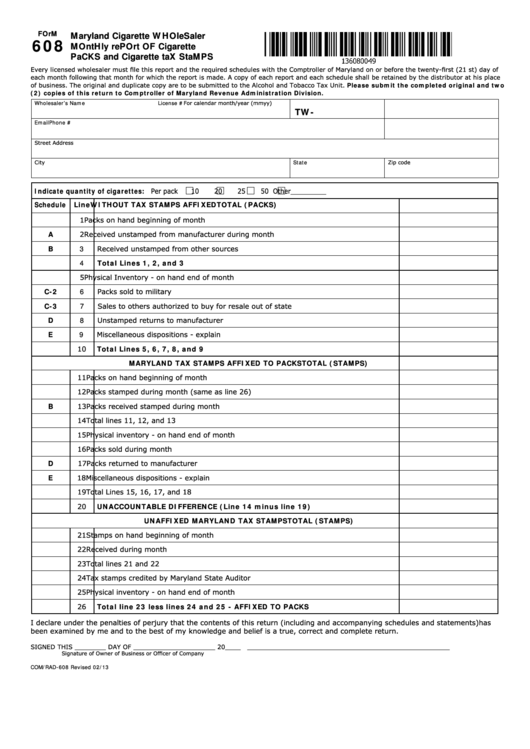

Maryland Cigarette WHOleSaler

FOrM

608

MOntHly rePOrt OF Cigarette

PaCKS and Cigarette taX StaMPS

Every licensed wholesaler must file this report and the required schedules with the Comptroller of Maryland on or before the twenty-first (21 st) day of

each month following that month for which the report is made. A copy of each report and each schedule shall be retained by the distributor at his place

of business. The original and duplicate copy are to be submitted to the Alcohol and Tobacco Tax Unit. Please submit the completed original and two

(2) copies of this return to Comptroller of Maryland Revenue Administration Division.

Wholesaler’s Name

License #

For calendar month/year (mmyy)

TW-

Email

Phone #

Street Address

City

State

Zip code

Indicate quantity of cigarettes: Per pack

10

20

25

50 Other_________

Schedule Line

WITHOUT TAX STAMPS AFFIXED

TOTAL (PACKS)

1

Packs on hand beginning of month

A

2

Received unstamped from manufacturer during month

B

3

Received unstamped from other sources

4

Total Lines 1, 2, and 3

5

Physical Inventory - on hand end of month

C-2

6

Packs sold to military

C-3

7

Sales to others authorized to buy for resale out of state

D

8

Unstamped returns to manufacturer

E

9

Miscellaneous dispositions - explain

10

Total Lines 5, 6, 7, 8, and 9

MARYLAND TAX STAMPS AFFIXED TO PACKS

TOTAL (STAMPS)

11

Packs on hand beginning of month

12

Packs stamped during month (same as line 26)

B

13

Packs received stamped during month

14

Total lines 11, 12, and 13

15

Physical inventory - on hand end of month

16

Packs sold during month

D

17

Packs returned to manufacturer

E

18

Miscellaneous dispositions - explain

19

Total Lines 15, 16, 17, and 18

20

UNACCOUNTABLE DIFFERENCE (Line 14 minus line 19)

UNAFFIXED MARYLAND TAX STAMPS

TOTAL (STAMPS)

21

Stamps on hand beginning of month

22

Received during month

23

Total lines 21 and 22

24

Tax stamps credited by Maryland State Auditor

25

Physical inventory - on hand end of month

26

Total line 23 less lines 24 and 25 - AFFIXED TO PACKS

I declare under the penalties of perjury that the contents of this return (including and accompanying schedules and statements)has

been examined by me and to the best of my knowledge and belief is a true, correct and complete return.

SIGNED THIS ________ DAY OF _____________________ 20____

____________________________________________________

Signature of Owner of Business or Officer of Company

COM/RAD-608

Revised 02/13

1

1 2

2