Form 4577 - Business Tax Schedule Of Shareholders And Officers - 2014 Page 2

ADVERTISEMENT

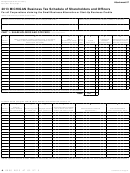

4577, Page 2

FEIN or TR Number

UBG Member FEIN or TR Number

PART 2: LIST OF FAMILY MEMBERS AND THEIR CORRESPONDING RELATIONSHIP TYPE

Using the same Member Number references from Part 1, indicate your attributable family relationship (if any) to each shareholder.

(An attributable family relationship is defined as either a spouse, parent, child or grandchild.)

•

If an attributable family relationship exists, designate in columns P through S

•

If no attributable family relationship exists, check box in column T.

2. O

P

Q

R

S

T

Check (X) if

Member

No Attributable

Number

Child

Grandchild

Spouse

Parent

Relationship

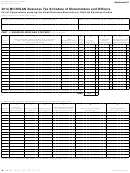

PART 3: SMALL BUSINESS ALTERNATIVE CREDIT

See instructions for definition of active shareholder.

.

3. Compensation and director fees of active shareholders. Add amounts in column L for each active

shareholder. Enter here and on Form 4571, line 6 .............................................................................

00

3.

4. Compensation and director fees of officers. Add amounts in column L for each officer who is not

an active shareholder. Enter here and on Form 4571, line 7..............................................................

00

4.

+

0000 2014 47 02 27 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5