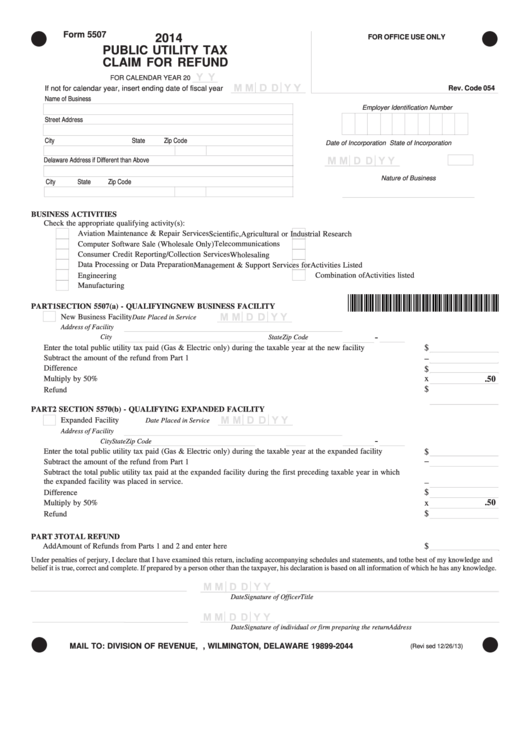

Form 5507 - Public Utility Tax Claim For Refund - 2014

ADVERTISEMENT

Form 5507

2014

FOR OFFICE USE ONLY

PUBLIC UTILITY TAX

CLAIM FOR REFUND

FOR CALENDAR YEAR 20

If not for calendar year, insert ending date of fiscal year

Rev. Code 054

Name of Business

Employer Identification Number

Street Address

City

State

Zip Code

Date of Incorporation

State of Incorporation

Delaware Address if Different than Above

Nature of Business

City

State

Zip Code

BUSINESS ACTIVITIES

Check the appropriate qualifying activity(s):

Aviation Maintenance & Repair Services

Scientific, Agricultural or Industrial Research

Computer Software Sale (Wholesale Only)

Telecommunications

Consumer Credit Reporting/Collection Services

Wholesaling

Data Processing or Data Preparation

Management & Support Services for Activities Listed

Combination of Activities listed

Engineering

Manufacturing

*DF42514019999*

PART 1 SECTION 5507(a) - QUALIFYING NEW BUSINESS FACILITY

New Business Facility

Date Placed in Service

Address of Facility

-

City

State

Zip Code

Enter the total public utility tax paid (Gas & Electric only) during the taxable year at the new facility

$

Subtract the amount of the refund from Part 1

–

Difference

$

x

Multiply by 50%

.50

$

Refund

PART 2 SECTION 5570(b) - QUALIFYING EXPANDED FACILITY

Expanded Facility

Date Placed in Service

Address of Facility

-

City

State

Zip Code

Enter the total public utility tax paid (Gas & Electric only) during the taxable year at the expanded facility

$

–

Subtract the amount of the refund from Part 1

Subtract the total public utility tax paid at the expanded facility during the first preceding taxable year in which

the expanded facility was placed in service.

–

$

Difference

x

.50

Multiply by 50%

$

Refund

PART 3 TOTAL REFUND

Add Amount of Refunds from Parts 1 and 2 and enter here

$

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and

belief it is true, correct and complete. If prepared by a person other than the taxpayer, his declaration is based on all information of which he has any knowledge.

Signature of Officer

Date

Title

Signature of individual or firm preparing the return

Date

Address

MAIL TO: DIVISION OF REVENUE, P.O. BOX 2044, WILMINGTON, DELAWARE 19899-2044

(Revi sed 12/26/13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2