2012

*VA0IAB212000*

Virginia

Schedule of Related Entity

Schedule 500AB

Add Backs and Exceptions

Page 2

Name as shown on Virginia return ____________________________________ Federal Employer ID Number _______________________

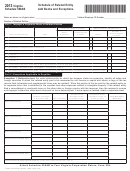

Exception 2 (One-Third Revenue): For each related entity for which the taxpayer claims an exception, identify the three

unrelated parties paying the highest amount of royalties to the related entity. Enter the amount of royalties that the Taxpayer

paid to the related entity that were made at rates and terms comparable to the agreements made with the unrelated parties.

If the total royalties and other expenses related to intangible property paid to unrelated parties do not equal or exceed one-

third of the gross revenues of the related entity, the payments to that related entity do not qualify for the exception. If more

space is needed, attach a separate sheet.

Royalties Paid By

Total Qualifying

Three Unrelated Parties Paying Royalties

Unrelated Party

Royalties

Name of Related Entity

1

2

Gross Revenues of Related Entity

3

4 All Other Unrelated Parties Paying Royalties

Name of Related Entity

1

2

Gross Revenues of Related Entity

3

4 All Other Unrelated Parties Paying Royalties

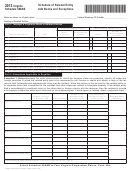

Name of Related Entity

1

2

Gross Revenues of Related Entity

3

4 All Other Unrelated Parties Paying Royalties

Name of Related Entity

1

2

Gross Revenues of Related Entity

3

4 All Other Unrelated Parties Paying Royalties

Total Royalties Qualifying for Exception 2 (Also enter the amount in Part I, Line 6 ).

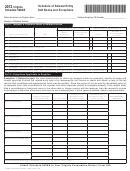

Exception 3 (Conduit): For each related entity for which the taxpayer claims an exception, identify the unrelated party to

whom the related entity paid a royalty for the same intangible property licensed to the Taxpayer, and describe the purpose

of the licensing transactions between the parties in order to demonstrate that the licensing transaction did not have as its

principal purpose the avoidance of tax. Enter the amount of royalties that the related entity paid to the unrelated party. If

more space is needed, attach a separate sheet.

Total Qualifying

Royalties

Name of Related Entity

Name of Unrelated Entity

Purpose of Transaction

Name of Related Entity

Name of Unrelated Entity

Purpose of Transaction

Name of Related Entity

Name of Unrelated Entity

Purpose of Transaction

Name of Related Entity

Name of Unrelated Entity

Purpose of Transaction

Total Royalties Qualifying For Exception 3 (Also enter the amount in Part I, Line 7.)

Attach Schedule 500AB to Your Virginia Corporation Return, Form 500

1

1 2

2