Form 11-C(V),

Payment Voucher

Purpose of Form

Box 2. Enter the amount paid with Form 11-C.

Box 3. Enter the same year and month you entered on

Complete Form 11-C(V), Payment Voucher, and file it

the “Return for period from” line at the top of Form 11-C.

with Form 11-C, Occupational Tax and Registration

For example, if your return is for the full period that begins

Return for Wagering. We will use Form 11-C(V) to credit

July 1, 2012, enter 201207.

your payment more promptly and accurately, and to

improve our service to you.

Box 4. Enter your name and address as shown on Form

11-C.

If you have your return prepared by a third party,

provide Form 11-C(V) to the return preparer.

• Enclose your check or money order made payable to

“United States Treasury.” Be sure to enter your EIN,

Specific Instructions

“Form 11-C,” and the tax period on your check or money

Box 1. If you do not have an EIN, apply for one online.

order. Do not send cash. Do not staple Form 11-C(V) or

Go to the IRS website at

your payment to Form 11-C (or to each other).

and click on the “Employer ID Numbers” link. You may

• Detach Form 11-C(V) and send it with your payment

also apply for an EIN by calling 1-800-829-4933, or you

and Form 11-C. See Where to file on page 3.

can fax or mail Form SS-4, Application for Employer

Identification Number, to the IRS.

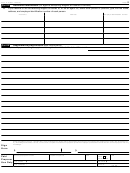

Detach Here and Mail With Your Payment and Form 11-C.

▼

▼

11-C(V)

Payment Voucher

OMB No. 1545-0123

(Rev. December 2013)

Department of the Treasury

Do not staple or attach this voucher to your payment or Form 11-C.

▶

Internal Revenue Service

1 Enter your employer identification

Dollars

Cents

2

Enter the amount of your payment.

▶

number.

Make your check or money order payable to “United States Treasury”

3 Enter year and month as shown on Form 11-C.

4 Enter your business name (individual name if sole proprietor).

Y

Y

Y

Y

M

M

Enter your address.

Send Form 11-C, this voucher, and payment to:

Department of the Treasury

Enter your city or town, state or province, country, and ZIP or foreign postal code.

Internal Revenue Service

Cincinnati, OH 45999-0101

1

1 2

2 3

3 4

4 5

5 6

6