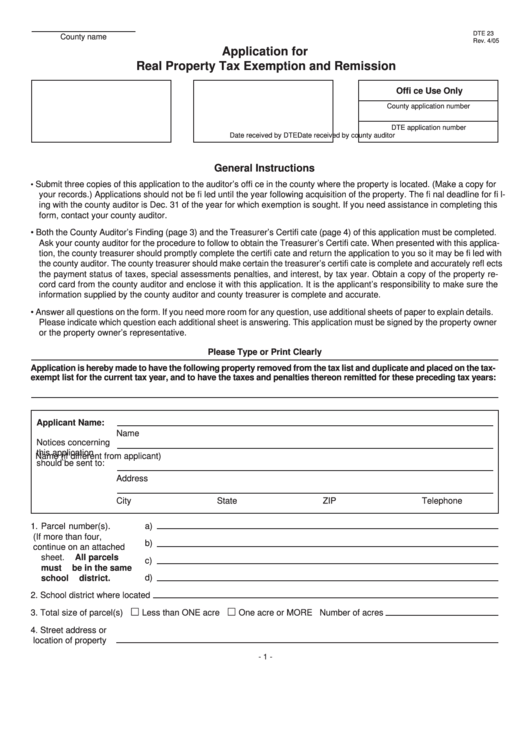

Reset Form

DTE 23

County name

Rev. 4/05

Application for

Real Property Tax Exemption and Remission

Offi ce Use Only

County application number

DTE application number

Date received by county auditor

Date received by DTE

General Instructions

Submit three copies of this application to the auditor’s offi ce in the county where the property is located. (Make a copy for

•

your records.) Applications should not be fi led until the year following acquisition of the property. The fi nal deadline for fi l-

ing with the county auditor is Dec. 31 of the year for which exemption is sought. If you need assistance in completing this

form, contact your county auditor.

• Both the County Auditor’s Finding (page 3) and the Treasurer’s Certifi cate (page 4) of this application must be completed.

Ask your county auditor for the procedure to follow to obtain the Treasurer’s Certifi cate. When presented with this applica-

tion, the county treasurer should promptly complete the certifi cate and return the application to you so it may be fi led with

the county auditor. The county treasurer should make certain the treasurer’s certifi cate is complete and accurately refl ects

the payment status of taxes, special assessments penalties, and interest, by tax year. Obtain a copy of the property re-

cord card from the county auditor and enclose it with this application. It is the applicant’s responsibility to make sure the

information supplied by the county auditor and county treasurer is complete and accurate.

• Answer all questions on the form. If you need more room for any question, use additional sheets of paper to explain details.

Please indicate which question each additional sheet is answering. This application must be signed by the property owner

or the property owner’s representative.

Please Type or Print Clearly

Application is hereby made to have the following property removed from the tax list and duplicate and placed on the tax-

exempt list for the current tax year, and to have the taxes and penalties thereon remitted for these preceding tax years:

Applicant Name:

Name

Notices concerning

this application

Name (if different from applicant)

should be sent to:

Address

City

State

ZIP

Telephone number

a)

1. Parcel number(s).

(If more than four,

b)

continue on an attached

sheet. All parcels

c)

must be in the same

d)

school district.

2. School district where located

3. Total size of parcel(s)

Less than ONE acre

One acre or MORE Number of acres

4. Street address or

location of property

- 1 -

1

1 2

2 3

3 4

4