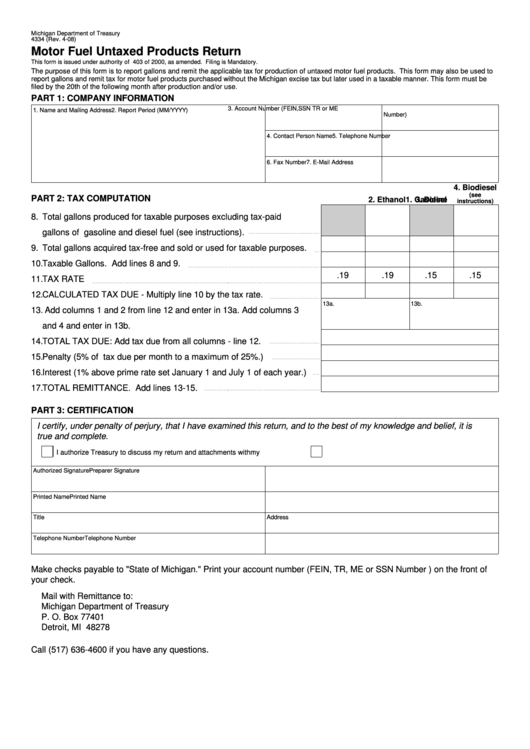

Michigan Department of Treasury

4334 (Rev. 4-08)

Motor Fuel Untaxed Products Return

This form is issued under authority of P.A. 403 of 2000, as amended. Filing is Mandatory.

The purpose of this form is to report gallons and remit the applicable tax for production of untaxed motor fuel products. This form may also be used to

report gallons and remit tax for motor fuel products purchased without the Michigan excise tax but later used in a taxable manner. This form must be

filed by the 20th of the following month after production and/or use.

PART 1: COMPANY INFORMATION

3. Account Number (FEIN,SSN TR or ME

1. Name and Mailing Address

2. Report Period (MM/YYYY)

Number)

4. Contact Person Name

5. Telephone Number

6. Fax Number

7. E-Mail Address

4. Biodiesel

(see

PART 2: TAX COMPUTATION

1. Gasoline

2. Ethanol

3. Diesel

instructions)

8.

Total gallons produced for taxable purposes excluding tax-paid

gallons of gasoline and diesel fuel (see instructions).

9.

Total gallons acquired tax-free and sold or used for taxable purposes.

10.

Taxable Gallons. Add lines 8 and 9.

.19

.19

.15

.15

11.

TAX RATE

12.

CALCULATED TAX DUE - Multiply line 10 by the tax rate.

13a.

13b.

13.

Add columns 1 and 2 from line 12 and enter in 13a. Add columns 3

and 4 and enter in 13b.

14.

TOTAL TAX DUE: Add tax due from all columns - line 12.

15.

Penalty (5% of tax due per month to a maximum of 25%.)

16.

Interest (1% above prime rate set January 1 and July 1 of each year.)

17.

TOTAL REMITTANCE. Add lines 13-15.

PART 3: CERTIFICATION

I certify, under penalty of perjury, that I have examined this return, and to the best of my knowledge and belief, it is

true and complete.

I authorize Treasury to discuss my return and attachments with my preparer.

Do not discuss my return with my preparer.

Authorized Signature

Preparer Signature

Printed Name

Printed Name

Title

Address

Telephone Number

Telephone Number

Make checks payable to "State of Michigan." Print your account number (FEIN, TR, ME or SSN Number ) on the front of

your check.

Mail with Remittance to:

Michigan Department of Treasury

P. O. Box 77401

Detroit, MI 48278

Call (517) 636-4600 if you have any questions.

1

1 2

2