Reset Form

DTE 140M

Rev. 5/11

O.R.C. §5705.03(B)

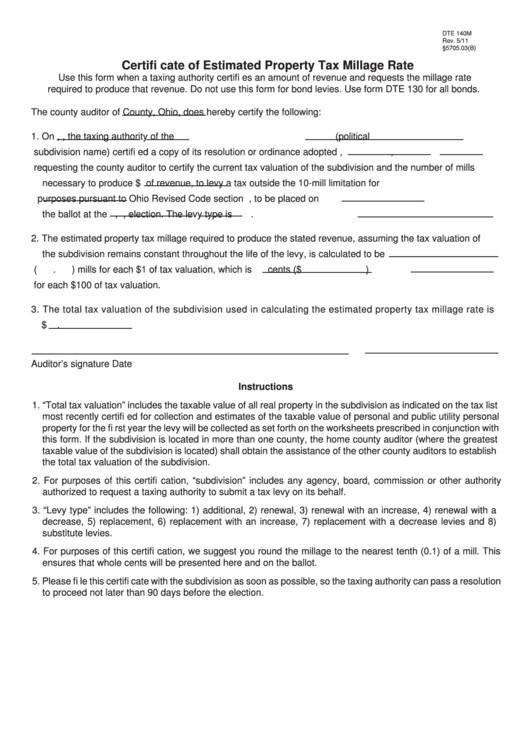

Certifi cate of Estimated Property Tax Millage Rate

Use this form when a taxing authority certifi es an amount of revenue and requests the millage rate

required to produce that revenue. Do not use this form for bond levies. Use form DTE 130 for all bonds.

The county auditor of

County, Ohio, does hereby certify the following:

1. On

,

, the taxing authority of the

(political

subdivision name) certifi ed a copy of its resolution or ordinance adopted

,

,

requesting the county auditor to certify the current tax valuation of the subdivision and the number of mills

necessary to produce $

of revenue, to levy a tax outside the 10-mill limitation for

purposes pursuant to Ohio Revised Code section

, to be placed on

the ballot at the

,

, election. The levy type is

.

2. The estimated property tax millage required to produce the stated revenue, assuming the tax valuation of

the subdivision remains constant throughout the life of the levy, is calculated to be

(

.

) mills for each $1 of tax valuation, which is

cents ($

)

for each $100 of tax valuation.

3. The total tax valuation of the subdivision used in calculating the estimated property tax millage rate is

$

.

Auditor’s signature

Date

Instructions

1. “Total tax valuation” includes the taxable value of all real property in the subdivision as indicated on the tax list

most recently certifi ed for collection and estimates of the taxable value of personal and public utility personal

property for the fi rst year the levy will be collected as set forth on the worksheets prescribed in conjunction with

this form. If the subdivision is located in more than one county, the home county auditor (where the greatest

taxable value of the subdivision is located) shall obtain the assistance of the other county auditors to establish

the total tax valuation of the subdivision.

2. For purposes of this certifi cation, “subdivision” includes any agency, board, commission or other authority

authorized to request a taxing authority to submit a tax levy on its behalf.

3. “Levy type” includes the following: 1) additional, 2) renewal, 3) renewal with an increase, 4) renewal with a

decrease, 5) replacement, 6) replacement with an increase, 7) replacement with a decrease levies and 8)

substitute levies.

4. For purposes of this certifi cation, we suggest you round the millage to the nearest tenth (0.1) of a mill. This

ensures that whole cents will be presented here and on the ballot.

5. Please fi le this certifi cate with the subdivision as soon as possible, so the taxing authority can pass a resolution

to proceed not later than 90 days before the election.

1

1