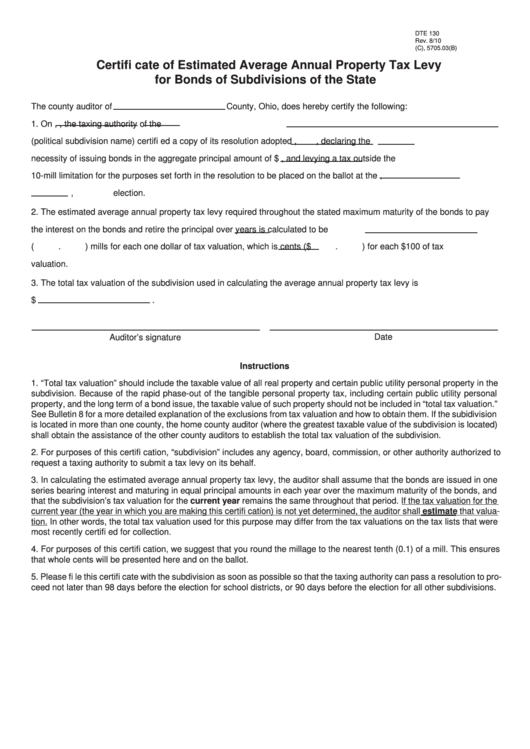

DTE 130

Reset Form

Rev. 8/10

O.R.C. 133.18(C), 5705.03(B)

Certifi cate of Estimated Average Annual Property Tax Levy

for Bonds of Subdivisions of the State

The county auditor of

County, Ohio, does hereby certify the following:

1. On

,

, the taxing authority of the

(political subdivision name) certifi ed a copy of its resolution adopted

,

, declaring the

necessity of issuing bonds in the aggregate principal amount of $

, and levying a tax outside the

10-mill limitation for the purposes set forth in the resolution to be placed on the ballot at the

,

, election.

2. The estimated average annual property tax levy required throughout the stated maximum maturity of the bonds to pay

the interest on the bonds and retire the principal over

years is calculated to be

(

.

) mills for each one dollar of tax valuation, which is

cents ($

.

) for each $100 of tax

valuation.

3. The total tax valuation of the subdivision used in calculating the average annual property tax levy is

$

.

Date

Auditor’s signature

Instructions

1. “Total tax valuation” should include the taxable value of all real property and certain public utility personal property in the

subdivision. Because of the rapid phase-out of the tangible personal property tax, including certain public utility personal

property, and the long term of a bond issue, the taxable value of such property should not be included in “total tax valuation.”

See Bulletin 8 for a more detailed explanation of the exclusions from tax valuation and how to obtain them. If the subidivision

is located in more than one county, the home county auditor (where the greatest taxable value of the subdivision is located)

shall obtain the assistance of the other county auditors to establish the total tax valuation of the subdivision.

2. For purposes of this certifi cation, “subdivision” includes any agency, board, commission, or other authority authorized to

request a taxing authority to submit a tax levy on its behalf.

3. In calculating the estimated average annual property tax levy, the auditor shall assume that the bonds are issued in one

series bearing interest and maturing in equal principal amounts in each year over the maximum maturity of the bonds, and

that the subdivision’s tax valuation for the current year remains the same throughout that period. If the tax valuation for the

current year (the year in which you are making this certifi cation) is not yet determined, the auditor shall estimate that valua-

tion. In other words, the total tax valuation used for this purpose may differ from the tax valuations on the tax lists that were

most recently certifi ed for collection.

4. For purposes of this certifi cation, we suggest that you round the millage to the nearest tenth (0.1) of a mill. This ensures

that whole cents will be presented here and on the ballot.

5. Please fi le this certifi cate with the subdivision as soon as possible so that the taxing authority can pass a resolution to pro-

ceed not later than 98 days before the election for school districts, or 90 days before the election for all other subdivisions.

1

1