Reset Form

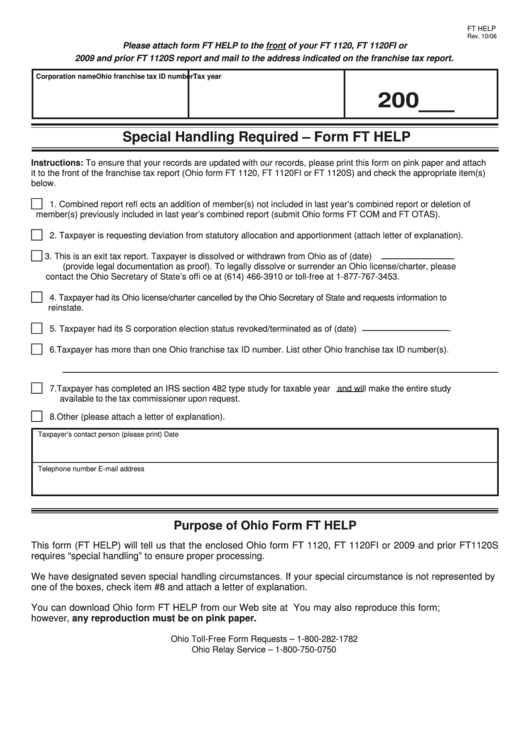

FT HELP

Rev. 10/06

Please attach form FT HELP to the front of your FT 1120, FT 1120FI or

2009 and prior FT 1120S report and mail to the address indicated on the franchise tax report.

Corporation name

Ohio franchise tax ID number

Tax year

__

200

Special Handling Required – Form FT HELP

Instructions: To ensure that your records are updated with our records, please print this form on pink paper and attach

it to the front of the franchise tax report (Ohio form FT 1120, FT 1120FI or FT 1120S) and check the appropriate item(s)

below.

1. Combined report refl ects an addition of member(s) not included in last year’s combined report or deletion of

member(s) previously included in last year’s combined report (submit Ohio forms FT COM and FT OTAS).

2. Taxpayer is requesting deviation from statutory allocation and apportionment (attach letter of explanation).

3. This is an exit tax report. Taxpayer is dissolved or withdrawn from Ohio as of (date)

(provide legal documentation as proof). To legally dissolve or surrender an Ohio license/charter, please

contact the Ohio Secretary of State’s offi ce at (614) 466-3910 or toll-free at 1-877-767-3453.

4. Taxpayer had its Ohio license/charter cancelled by the Ohio Secretary of State and requests information to

reinstate.

5. Taxpayer had its S corporation election status revoked/terminated as of (date)

.

6. Taxpayer has more than one Ohio franchise tax ID number. List other Ohio franchise tax ID number(s).

7. Taxpayer has completed an IRS section 482 type study for taxable year

and will make the entire study

available to the tax commissioner upon request.

8. Other (please attach a letter of explanation).

Taxpayer’s contact person (please print)

Date

Telephone number

E-mail address

Purpose of Ohio Form FT HELP

This form (FT HELP) will tell us that the enclosed Ohio form FT 1120, FT 1120FI or 2009 and prior FT1120S

requires “special handling” to ensure proper processing.

We have designated seven special handling circumstances. If your special circumstance is not represented by

one of the boxes, check item #8 and attach a letter of explanation.

You can download Ohio form FT HELP from our Web site at tax.ohio.gov. You may also reproduce this form;

however, any reproduction must be on pink paper.

Ohio Toll-Free Form Requests – 1-800-282-1782

Ohio Relay Service – 1-800-750-0750

tax.ohio.gov

1

1