Form Ft-959 - Special Fuel Tax Return For Unregistered Distributors

ADVERTISEMENT

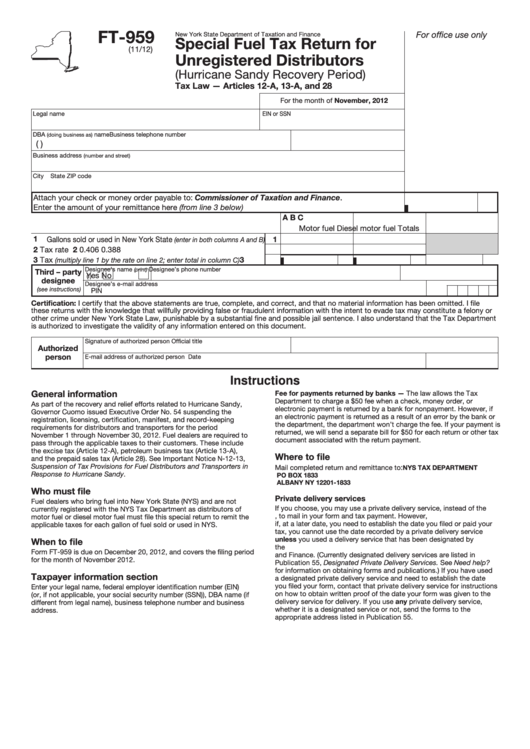

FT-959

For office use only

New York State Department of Taxation and Finance

Special Fuel Tax Return for

(11/12)

Unregistered Distributors

(Hurricane Sandy Recovery Period)

Tax Law — Articles 12-A, 13-A, and 28

For the month of November, 2012

Legal name

EIN or SSN

DBA

name

Business telephone number

(doing business as)

(

)

Business address

(number and street)

City

State

ZIP code

Attach your check or money order payable to: Commissioner of Taxation and Finance.

Enter the amount of your remittance here (from line 3 below) .........................................................................

A

B

C

Motor fuel

Diesel motor fuel

Totals

1 Gallons sold or used in New York State

1

(enter in both columns A and B)

2 Tax rate ......................................................................................

2

0.406

0.388

3 Tax

.......

3

(multiply line 1 by the rate on line 2; enter total in column C)

Designee’s name

Designee’s phone number

(print)

Third – party

Yes

No

(

)

designee

Designee’s e-mail address

(see instructions)

PIN

Certification: I certify that the above statements are true, complete, and correct, and that no material information has been omitted. I file

these returns with the knowledge that willfully providing false or fraudulent information with the intent to evade tax may constitute a felony or

other crime under New York State Law, punishable by a substantial fine and possible jail sentence. I also understand that the Tax Department

is authorized to investigate the validity of any information entered on this document.

Signature of authorized person

Official title

Authorized

person

E-mail address of authorized person

Date

Instructions

General information

Fee for payments returned by banks — The law allows the Tax

Department to charge a $50 fee when a check, money order, or

As part of the recovery and relief efforts related to Hurricane Sandy,

electronic payment is returned by a bank for nonpayment. However, if

Governor Cuomo issued Executive Order No. 54 suspending the

an electronic payment is returned as a result of an error by the bank or

registration, licensing, certification, manifest, and record-keeping

the department, the department won’t charge the fee. If your payment is

requirements for distributors and transporters for the period

returned, we will send a separate bill for $50 for each return or other tax

November 1 through November 30, 2012. Fuel dealers are required to

document associated with the return payment.

pass through the applicable taxes to their customers. These include

the excise tax (Article 12-A), petroleum business tax (Article 13-A),

Where to file

and the prepaid sales tax (Article 28). See Important Notice N-12-13,

Suspension of Tax Provisions for Fuel Distributors and Transporters in

:

Mail completed return and remittance to

NYS TAX DEPARTMENT

Response to Hurricane Sandy.

PO BOX 1833

ALBANY NY 12201-1833

Who must file

Private delivery services

Fuel dealers who bring fuel into New York State (NYS) and are not

If you choose, you may use a private delivery service, instead of the

currently registered with the NYS Tax Department as distributors of

U.S. Postal Service, to mail in your form and tax payment. However,

motor fuel or diesel motor fuel must file this special return to remit the

if, at a later date, you need to establish the date you filed or paid your

applicable taxes for each gallon of fuel sold or used in NYS.

tax, you cannot use the date recorded by a private delivery service

unless you used a delivery service that has been designated by

When to file

the U.S. Secretary of the Treasury or the Commissioner of Taxation

Form FT-959 is due on December 20, 2012, and covers the filing period

and Finance. (Currently designated delivery services are listed in

for the month of November 2012.

Publication 55, Designated Private Delivery Services. See Need help?

for information on obtaining forms and publications.) If you have used

Taxpayer information section

a designated private delivery service and need to establish the date

you filed your form, contact that private delivery service for instructions

Enter your legal name, federal employer identification number (EIN)

on how to obtain written proof of the date your form was given to the

(or, if not applicable, your social security number (SSN)), DBA name (if

delivery service for delivery. If you use any private delivery service,

different from legal name), business telephone number and business

whether it is a designated service or not, send the forms to the

address.

appropriate address listed in Publication 55.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2