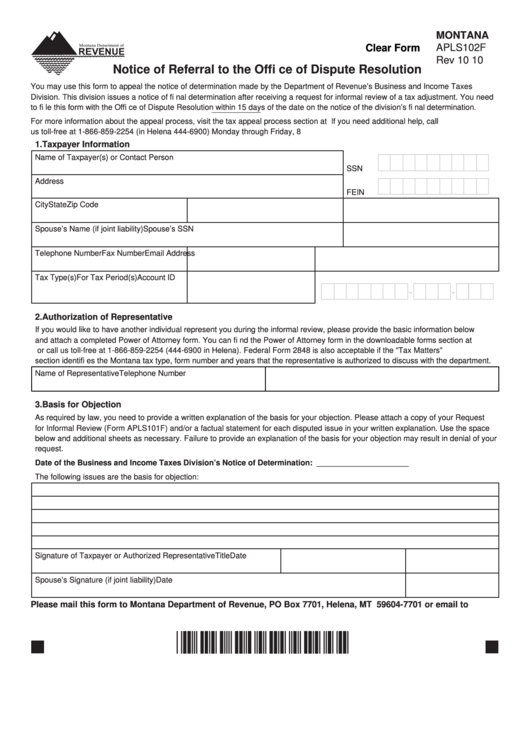

MONTANA

Clear Form

APLS102F

Rev 10 10

Notice of Referral to the Offi ce of Dispute Resolution

You may use this form to appeal the notice of determination made by the Department of Revenue’s Business and Income Taxes

Division. This division issues a notice of fi nal determination after receiving a request for informal review of a tax adjustment. You need

to fi le this form with the Offi ce of Dispute Resolution within 15 days of the date on the notice of the division’s fi nal determination.

For more information about the appeal process, visit the tax appeal process section at revenue.mt.gov. If you need additional help, call

us toll-free at 1-866-859-2254 (in Helena 444-6900) Monday through Friday, 8 a.m. to 5 p.m.

1. Taxpayer Information

Name of Taxpayer(s) or Contact Person

SSN

Address

FEIN

City

State

Zip Code

Spouse’s Name (if joint liability)

Spouse’s SSN

Telephone Number

Fax Number

Email Address

Tax Type(s)

For Tax Period(s)

Account ID

-

-

2. Authorization of Representative

If you would like to have another individual represent you during the informal review, please provide the basic information below

and attach a completed Power of Attorney form. You can fi nd the Power of Attorney form in the downloadable forms section at

revenue.mt.gov or call us toll-free at 1-866-859-2254 (444-6900 in Helena). Federal Form 2848 is also acceptable if the “Tax Matters”

section identifi es the Montana tax type, form number and years that the representative is authorized to discuss with the department.

Name of Representative

Telephone Number

3. Basis for Objection

As required by law, you need to provide a written explanation of the basis for your objection. Please attach a copy of your Request

for Informal Review (Form APLS101F) and/or a factual statement for each disputed issue in your written explanation. Use the space

below and additional sheets as necessary. Failure to provide an explanation of the basis for your objection may result in denial of your

request.

Date of the Business and Income Taxes Division’s Notice of Determination: _____________________

The following issues are the basis for objection:

Signature of Taxpayer or Authorized Representative

Title

Date

Spouse’s Signature (if joint liability)

Date

Please mail this form to Montana Department of Revenue, PO Box 7701, Helena, MT 59604-7701 or email to

soaobjections@mt.gov.

*05020101*

1

1