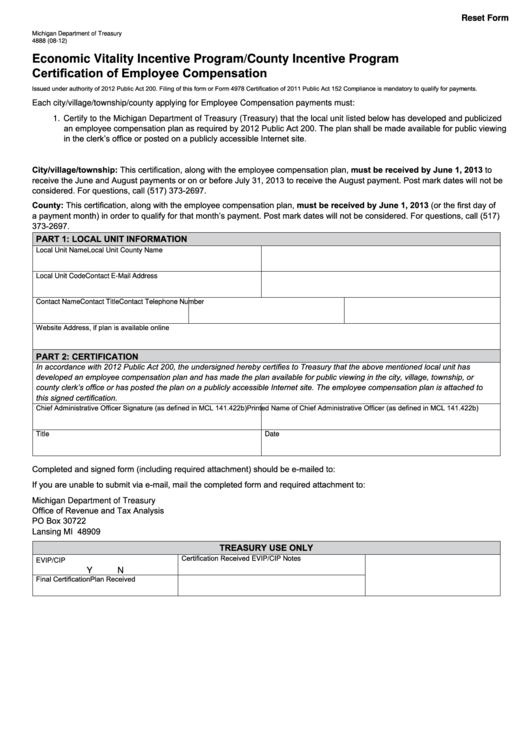

Reset Form

Michigan Department of Treasury

4888 (08-12)

Economic Vitality Incentive Program/County Incentive Program

Certification of Employee Compensation

Issued under authority of 2012 Public Act 200. Filing of this form or Form 4978 Certification of 2011 Public Act 152 Compliance is mandatory to qualify for payments.

Each city/village/township/county applying for Employee Compensation payments must:

1. Certify to the Michigan Department of Treasury (Treasury) that the local unit listed below has developed and publicized

an employee compensation plan as required by 2012 Public Act 200. The plan shall be made available for public viewing

in the clerk’s office or posted on a publicly accessible Internet site.

2. Submit to Treasury an employee compensation plan.

City/village/township: This certification, along with the employee compensation plan, must be received by June 1, 2013 to

receive the June and August payments or on or before July 31, 2013 to receive the August payment. Post mark dates will not be

considered. For questions, call (517) 373-2697.

County: This certification, along with the employee compensation plan, must be received by June 1, 2013 (or the first day of

a payment month) in order to qualify for that month’s payment. Post mark dates will not be considered. For questions, call (517)

373-2697.

PART 1: LOCAL UNIT INFORMATION

Local Unit Name

Local Unit County Name

Local Unit Code

Contact E-Mail Address

Contact Name

Contact Title

Contact Telephone Number

Website Address, if plan is available online

PART 2: CERTIFICATION

In accordance with 2012 Public Act 200, the undersigned hereby certifies to Treasury that the above mentioned local unit has

developed an employee compensation plan and has made the plan available for public viewing in the city, village, township, or

county clerk’s office or has posted the plan on a publicly accessible Internet site. The employee compensation plan is attached to

this signed certification.

Chief Administrative Officer Signature (as defined in MCL 141.422b)

Printed Name of Chief Administrative Officer (as defined in MCL 141.422b)

Title

Date

Completed and signed form (including required attachment) should be e-mailed to: TreasRevenueSharing@michigan.gov

If you are unable to submit via e-mail, mail the completed form and required attachment to:

Michigan Department of Treasury

Office of Revenue and Tax Analysis

PO Box 30722

Lansing MI 48909

TREASURY USE ONLY

Certification Received

EVIP/CIP Notes

EVIP/CIP

Y

N

Final Certification

Plan Received

1

1