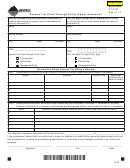

Form PT-STM Instructions

New! Beginning with tax year 2012, a copy of the Form

STM that the second-tier pass-through entity’s distributive

PT-STM will no longer be submitted with a pass-through

share of Montana source income is fully accounted for on

entity’s information return. Now a pass-through entity will

Montana individual, corporation license or other income tax

separately send the Form PT-STM to the Department of

returns, it does not submit the form.

Revenue at least 45 days before the original due date of

The department may grant a conditional waiver that lasts

the fi rst-tier pass-through entity’s return.

longer than one year. To request a multiple year waiver,

submit a written request with the Form PT-STM. The pass-

What is the purpose of this statement?

through entity must agree in the written request to:

When the owner of a pass-through entity (fi rst-tier) that

● notify the department if the ownership of the second-

has Montana source income is itself a pass-through

tier pass-through entity and the ownership of any

entity (second-tier), the fi rst-tier pass-through entity

higher-tier pass-through entity changes,

must either include the second-tier pass-through entity

● remit tax on behalf of the second-tier pass-through

in a composite return or pay tax on its behalf unless the

fi rst-tier establishes that its distributive share of Montana

entity within 60 days after notice from the department if

source income is fully accounted for on Montana individual

the second-tier pass-through entity’s distributive share

income, corporation license or other income tax returns.

of income was not fully accounted for on corporation

To establish this, the fi rst-tier pass-through entity must be

license, individual income or other income tax returns,

able to identify each entity (person, corporation, estate,

and

trust or composite fi ler) to which any part of its share of the

● be subject to the personal jurisdiction of the state for

Montana source income will pass.

the collection of the remittance.

Who prepares this statement?

The written request must also be signed by a general

partner or limited liability company member manager.

An authorized representative of the fi rst-tier pass-through

entity must complete this form. It is not valid unless it is

What if the fi rst-tier pass-through entity is part of

signed and dated by an offi cer or other individual who is

a multi-tiered structure and it cannot identify all

authorized to sign on behalf of the fi rst-tier pass-through

owners of all higher tiers?

entity.

The fi rst-tier pass-through entity must fi le a composite

The fi rst-tier pass-through entity must submit the Form PT-

return or pay tax on behalf of the second-tier pass-through

STM to the department at least 45 days before the original

entity unless each and every owner to whom any share

due date of the fi rst-tier pass-through entity’s return.

of Montana source income is passed is identifi ed and the

How does the fi rst-tier pass-through entity fi le the

fi rst-tier pass-through entity verifi es that every owner to

Form PT-STM?

which the Montana source income is distributed will fi le a

Montana return.

The fi rst-tier pass-through entity must submit the Form

PT-STM to the department 45 days before the original due

What happens if the statement is submitted to the

date of its return. For example if a return is due by April 15,

department and an entity to which the second-

2013, the Form PT-STM will be due by March 1, 2013.

tier pass-through entity’s share of income is

ultimately passed does not fi le a Montana tax

A pass-through entity can electronically fi le the Form PT-

STM through our website. Filing electronically is simple

return and pay the applicable tax?

and secure. In addition, the pass-through entity will receive

The department will assess the fi rst-tier pass-through entity

confi rmation that the form was fi led. For more information,

for its failure to pay tax for the second-tier pass-through

please visit revenue.mt.gov and check out Taxpayer Access

entity’s distributive share of Montana source income. The

Point (TAP).

amount that will be assessed is 6.9% multiplied by the

The Form PT-STM can also be mailed to:

distributive share of the second-tier pass-through entity’s

Montana source income. After the fi rst-tier pass-through

Montana Department of Revenue

entity pays this amount, the paid tax passes through the

Attn: Form PT-STM

multi-tiered structure as a refundable credit that may be

P.O. Box 5805

claimed by the owners who fi le their Montana individual

Helena, MT 59604-5805

income, corporation license or other income tax returns.

How often does the fi rst-tier pass-through entity

If the fi rst-tier pass-through entity does not pay

have to complete this statement?

tax due in a timely manner, will interest and

The fi rst-tier pass-through entity has to complete this

penalties be assessed?

statement each year it does not include the second-tier

Yes, if tax is not paid by the original fi ling deadline of the

pass-through entity in a composite return or pay tax on

fi rst-tier pass-through entity’s tax return, then any unpaid

its behalf unless it receives a multiple year waiver. If the

tax will be assessed interest and penalties until paid in full.

fi rst-tier pass-through entity cannot establish on Form PT-

1

1 2

2 3

3 4

4