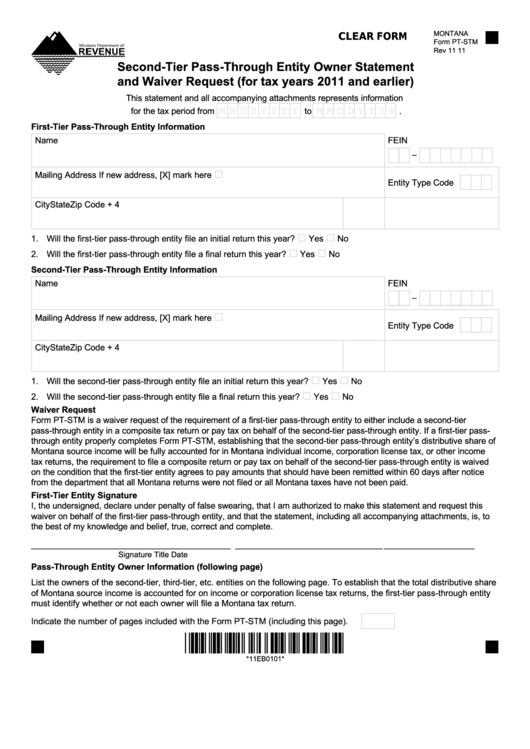

MONTANA

CLEAR FORM

Form PT-STM

Rev 11 11

Second-Tier Pass-Through Entity Owner Statement

and Waiver Request (for tax years 2011 and earlier)

This statement and all accompanying attachments represents information

M M D D Y Y Y Y

M M D D Y Y Y Y

for the tax period from

to

.

First-Tier Pass-Through Entity Information

Name

FEIN

-

Mailing Address

If new address, [X] mark here

Entity Type Code

City

State

Zip Code + 4

1. Will the first-tier pass-through entity file an initial return this year?

Yes

No

2. Will the first-tier pass-through entity file a final return this year?

Yes

No

Second-Tier Pass-Through Entity Information

Name

FEIN

-

Mailing Address

If new address, [X] mark here

Entity Type Code

City

State

Zip Code + 4

1. Will the second-tier pass-through entity file an initial return this year?

Yes

No

2. Will the second-tier pass-through entity file a final return this year?

Yes

No

Waiver Request

Form PT-STM is a waiver request of the requirement of a first-tier pass-through entity to either include a second-tier

pass-through entity in a composite tax return or pay tax on behalf of the second-tier pass-through entity. If a first-tier pass-

through entity properly completes Form PT-STM, establishing that the second-tier pass-through entity’s distributive share of

Montana source income will be fully accounted for in Montana individual income, corporation license tax, or other income

tax returns, the requirement to file a composite return or pay tax on behalf of the second-tier pass-through entity is waived

on the condition that the first-tier entity agrees to pay amounts that should have been remitted within 60 days after notice

from the department that all Montana returns were not filed or all Montana taxes have not been paid.

First-Tier Entity Signature

I, the undersigned, declare under penalty of false swearing, that I am authorized to make this statement and request this

waiver on behalf of the first-tier pass-through entity, and that the statement, including all accompanying attachments, is, to

the best of my knowledge and belief, true, correct and complete.

__________________________________________

_______________________________

___________________

Signature

Title

Date

Pass-Through Entity Owner Information (following page)

List the owners of the second-tier, third-tier, etc. entities on the following page. To establish that the total distributive share

of Montana source income is accounted for on income or corporation license tax returns, the first-tier pass-through entity

must identify whether or not each owner will file a Montana tax return.

Indicate the number of pages included with the Form PT-STM (including this page).

*11EB0101*

*11EB0101*

1

1 2

2 3

3 4

4