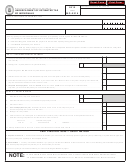

Form D-422 - Underpayment Of Estimated Tax By Individuals - 2012 Page 2

ADVERTISEMENT

Page 2

Last Name (First 10 Characters)

Your Social Security Number

D-422

Web

12-12

Part III. Regular Method

Payment Due Dates

(If the payment due date falls on a Saturday, Sunday or holiday, the

Section A - Figure Your Underpayment

payment is due on or before the next business day.)

(a)

(b)

(c)

(d)

4/15/12

6/15/12

9/15/12

1/15/13

1 6.

Divide line 8 by 4 and enter the result in each column. Exception: If you

use the annualized income installment method, complete Form D-422A

1 6.

(Annualized Income Installment Worksheet) and check this box.

1 7.

Estimated tax paid and tax withheld. For column (a) only, enter the

amount from line 17 on line 21. (If line 17 is equal to or more than

1 7.

line 16 for each payment period, stop here; you do not owe interest.)

Complete lines 18 through 24 of one column before going to the

next column.

1 8.

1 8.

Enter amount, if any, from line 24 of previous column.

1 9.

1 9.

Add lines 17 and 18.

2 0.

Add amounts on lines 22 and 23 of the previous column and

20.

enter the result.

2 1.

Subtract line 20 from line 19 and enter the result. If zero or less, enter

21.

zero. (For column (a) only, enter the amount from line 17.)

2 2.

Remaining underpayment from previous period. If the amount on line 21

is -0-, subtract line 19 from line 20 and enter the result. Otherwise,

22.

enter -0-.

2 3.

Underpayment. If line 16 is larger than or equal to line 21, subtract

line 21 from line 16 and enter the result. Enter -0- on line 18 of

23.

the next column and go to line 19. Otherwise, go to line 24.

2 4.

Overpayment. If line 21 is larger than line 16, subtract line 16 from line

24.

21 and enter the result. Then go to line 18 of next column.

Section B - Figure the Interest on Underpayment

(Complete lines 25 and 26 of one column before going to the next column)

4/15/12

6/15/12

9/15/12

1/15/13

April 15, 2012 - April 15, 2013

Days:

Days:

Days:

Days:

25.

Number of days after the date shown above line 25 through the date

the amount on line 23 was paid or 4/15/13, whichever is earlier.

25.

26.

U nderpayment

Number of days

X

X .05

on line 23

on line 25

( see instructions)

365

26. $

$

$

$

27.

$

27.

Interest on the underpayment (Add amounts on line 26.) Enter here and on Form D-400, line 27d.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2