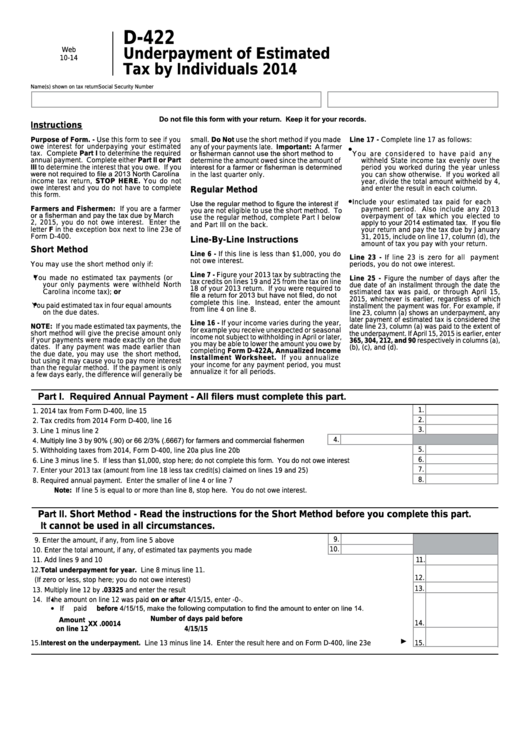

Form D-422 - Underpayment Of Estimated Tax By Individuals - 2014

ADVERTISEMENT

D-422

Web

Underpayment of Estimated

10-14

Tax by Individuals 2014

Name(s) shown on tax return

Social Security Number

Do not file this form with your return. Keep it for your records.

Instructions

Purpose of Form. - Use this form to see if you

small. Do Not use the short method if you made

Line 17 - Complete line 17 as follows:

owe interest for underpaying your estimated

any of your payments late. Important: A farmer

•

or fisherman cannot use the short method to

tax. Complete Part I to determine the required

You are considered to have paid any

annual payment. Complete either Part II or Part

determine the amount owed since the amount of

withheld State income tax evenly over the

interest for a farmer or fisherman is determined

III to determine the interest that you owe. If you

period you worked during the year unless

were not required to file a 2013 North Carolina

in the last quarter only.

you can show otherwise. If you worked all

income tax return, STOP HERE. You do not

year, divide the total amount withheld by 4,

owe interest and you do not have to complete

and enter the result in each column.

Regular Method

this form.

•

Use the regular method to figure the interest if

Include your estimated tax paid for each

Farmers and Fishermen: If you are a farmer

payment period. Also include any 2013

you are not eligible to use the short method. To

or a fisherman and pay the tax due by March

overpayment of tax which you elected to

use the regular method, complete Part I below

apply to your 2014 estimated tax. If you file

2, 2015, you do not owe interest. Enter the

and Part III on the back.

letter F in the exception box next to line 23e of

your return and pay the tax due by January

Form D-400.

31, 2015, include on line 17, column (d), the

Line-By-Line Instructions

amount of tax you pay with your return.

Short Method

Line 6 - If this line is less than $1,000, you do

Line 23 - If line 23 is zero for all payment

not owe interest.

You may use the short method only if:

periods, you do not owe interest.

•

Line 7 - Figure your 2013 tax by subtracting the

You made no estimated tax payments (or

Line 25 - Figure the number of days after the

tax credits on lines 19 and 25 from the tax on line

your only payments were withheld North

due date of an installment through the date the

18 of your 2013 return. If you were required to

Carolina income tax); or

estimated tax was paid, or through April 15,

file a return for 2013 but have not filed, do not

•

2015, whichever is earlier, regardless of which

complete this line. Instead, enter the amount

You paid estimated tax in four equal amounts

installment the payment was for. For example, if

from line 4 on line 8.

on the due dates.

line 23, column (a) shows an underpayment, any

later payment of estimated tax is considered the

Line 16 - If your income varies during the year,

NOTE: If you made estimated tax payments, the

date line 23, column (a) was paid to the extent of

for example you receive unexpected or seasonal

short method will give the precise amount only

the underpayment. If April 15, 2015 is earlier, enter

income not subject to withholding in April or later,

if your payments were made exactly on the due

365, 304, 212, and 90 respectively in columns (a),

you may be able to lower the amount you owe by

dates. If any payment was made earlier than

(b), (c), and (d).

completing Form D-422A, Annualized Income

the due date, you may use the short method,

Installment Worksheet. If you annualize

but using it may cause you to pay more interest

your income for any payment period, you must

than the regular method. If the payment is only

annualize it for all periods.

a few days early, the difference will generally be

Part I. Required Annual Payment - All filers must complete this part.

1.

1.

2014 tax from Form D-400, line 15 ....................................................................................................................................

2.

2.

Tax credits from 2014 Form D-400, line 16 ......................................................................................................................

3.

3.

Line 1 minus line 2 ............................................................................................................................................................

4.

Multiply line 3 by 90% (.90) or 66 2/3% (.6667) for farmers and commercial fishermen .....

4.

5.

5.

Withholding taxes from 2014, Form D-400, line 20a plus line 20b ....................................................................................

6.

6.

Line 3 minus line 5. If less than $1,000, stop here; do not complete this form. You do not owe interest ..........................

7.

7.

Enter your 2013 tax (amount from line 18 less tax credit(s) claimed on lines 19 and 25) .................................................

8.

8.

Required annual payment. Enter the smaller of line 4 or line 7 ........................................................................................

Note: If line 5 is equal to or more than line 8, stop here. You do not owe interest.

Part II. Short Method - Read the instructions for the Short Method before you complete this part.

It cannot be used in all circumstances.

9.

9.

Enter the amount, if any, from line 5 above .........................................................................

10.

10.

Enter the total amount, if any, of estimated tax payments you made ..................................

11.

Add lines 9 and 10 .............................................................................................................................................................

11.

12.

Total underpayment for year. Line 8 minus line 11.

12.

(If zero or less, stop here; you do not owe interest) ..........................................................................................................

13.

13.

Multiply line 12 by .03325 and enter the result ..................................................................................................................

•

14.

If the amount on line 12 was paid on or after 4/15/15, enter -0-.

•

If paid before 4/15/15, make the following computation to find the amount to enter on line 14.

Number of days paid before

Amount

14.

X

X

.00014

....................................

on line 12

4/15/15

15.

Interest on the underpayment. Line 13 minus line 14. Enter the result here and on Form D-400, line 23e ................

15.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2