● Name and Address ‒ For each owner of the second-

Use the following entity type codes to complete the

tier and higher tier pass-through entities (if applicable),

form:

provide the name, mailing address, entity type code

● C corporation doing business in MT (C)

and federal employer identifi cation number (FEIN) or

● C corporation not doing business in MT (FC)

social security number (SSN).

● Disregarded entity (DE)

● Residency Code ‒ If the owner is an individual, estate

or trust and a resident, mark the ‘R’ box. If the owner is

● Estate (E)

an individual, estate or trust and a nonresident, mark

● Individual (I)

the ‘N’ box.

● Partnership (PS)

● Composite – Indicate whether an owner is included

in a Montana composite return of a lower-tier pass-

● Publicly Traded Partnership (PTP)

through entity.

● S corporation (S)

● Will this owner fi le a MT tax return for the current

● Trust (T)

tax year? ‒ Indicate whether each owner will fi le a

Montana return this tax year.

If an entity is a nonprofi t organization, use entity type code

C for nonprofi t organizations formed in Montana and entity

If a fi rst-tier pass-through entity does not know whether

type code FC for nonprofi t organizations formed outside of

the owner will fi le a Montana return, then the form

Montana.

cannot be completed. Do not submit the form. The fi rst-

tier pass-through entity must include the second-tier

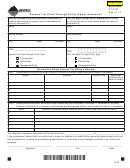

Page 1 – Second-Tier Pass-Through Entity Owner

pass-through entity in a composite tax return or pay tax

Statement and Waiver Request

on behalf of the second-tier pass-through entity.

Identify the tax year. If applying for a multiple year waiver,

● FEIN of the entity that this owner has an ownership

identify the tax year that the waiver should begin.

interest in – Include the FEIN of the entity in which the

● First-Tier Pass-Through Entity Information ‒ Enter

owner has an ownership interest. Identify the owner’s

the name, mailing address, entity type code and federal

ownership percentage as reported on the Montana

employer identifi cation number (FEIN) for the fi rst-tier

Schedule III included with the tax return of that entity.

pass-through entity.

Include additional copies of the second page if necessary.

● Second-Tier Pass-Through Entity Information ‒

Administrative Rules of Montana: 42.9.106

Enter the name, mailing address, entity type code and

federal employer identifi cation number (FEIN) for the

Questions? Please call us toll free at (866) 859-2254 (in

second-tier pass-through entity.

Helena, 444-6900).

Page 2 – Pass-Through Entity Owner Information

(third-tier, fourth-tier, etc.)

Unless the second-tier pass-through entity includes all of its

owners in a composite return, page 2 must be completed.

1

1 2

2 3

3 4

4