Form

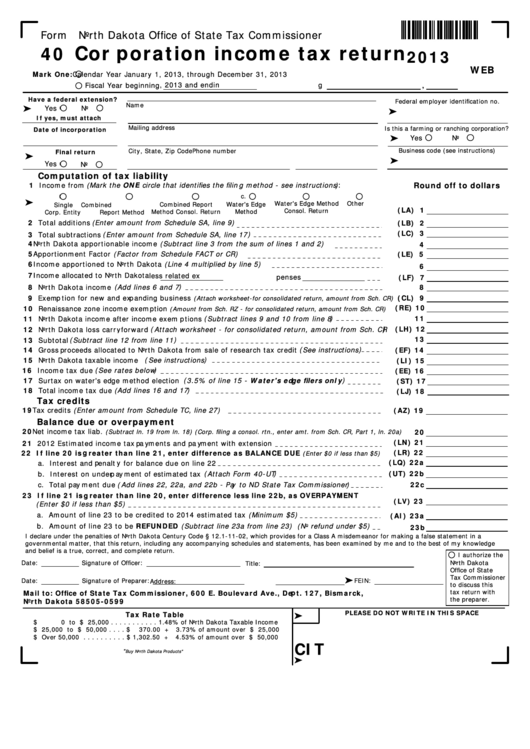

North Dakota Office of State Tax Commissioner

Corporation income tax return

40

2013

WEB

Mark One:

Calendar Year January 1, 2013, through December 31, 2013

, 2013 and ending

Fiscal Year beginning

,

Have a federal extension?

Federal employer identification no.

Name

®

Yes

No

®

If yes, must attach

Mailing address

Is this a farming or ranching corporation?

Date of incorporation

®

Yes

No

Business code (see instructions)

City, State, Zip Code

Phone number

Final return

®

®

Yes

No

Computation of tax liability

1 Income from (Mark the ONE circle that identifies the filing method - see instructions):

Round off to dollars

a.

b.

b1.

c.

c1.

d.

®

Water's Edge Method

Other

Water's Edge

Combined Report

Single

Combined

(LA) 1

Consol. Return

Method

Method Consol. Return

Corp. Entity

Report Method

2 Total additions (Enter amount from Schedule SA, line 9)

(LB) 2

(LC) 3

3 Total subtractions (Enter amount from Schedule SA, line 17)

4

4 North Dakota apportionable income (Subtract line 3 from the sum of lines 1 and 2)

(LE) 5

5 Apportionment Factor (Factor from Schedule FACT or CR)

6 Income apportioned to North Dakota (Line 4 multiplied by line 5)

6

7 Income allocated to North Dakota

less related expenses

(LF) 7

8 North Dakota income (Add lines 6 and 7)

8

9 Exemption for new and expanding business

(CL) 9

(Attach worksheet-for consolidated return, amount from Sch. CR)

(RE) 10

10 Renaissance zone income exemption

(Amount from Sch. RZ - for consolidated return, amount from Sch. CR)

11 North Dakota income after income exemptions (Subtract lines 9 and 10 from line 8)

11

(LH) 12

12 North Dakota loss carryforward (Attach worksheet - for consolidated return, amount from Sch. CR)

13

13 Subtotal (Subtract line 12 from line 11)

14 Gross proceeds allocated to North Dakota from sale of research tax credit (See instructions)

(EF) 14

15 North Dakota taxable income (See instructions)

(LI) 15

16 Income tax due (See rates below)

(EE) 16

17 Surtax on water's edge method election (3.5% of line 15 - Water's edge filers only)

(ST) 17

18 Total income tax due (Add lines 16 and 17)

(LJ) 18

Tax credits

(AZ) 19

19 Tax credits (Enter amount from Schedule TC, line 27)

Balance due or overpayment

20

20 Net income tax liab.

(Subtract ln. 19 from ln. 18) (Corp. filing a consol. rtn., enter amt. from Sch. CR, Part 1, ln. 20a)

(LN) 21

21 2012 Estimated income tax payments and payment with extension

(LR) 22

22 If line 20 is greater than line 21, enter difference as BALANCE DUE

(Enter $0 if less than $5)

(LQ) 22a

a. Interest and penalty for balance due on line 22

b. Interest on underpayment of estimated tax (Attach Form 40-UT)

(UT) 22b

c. Total payment due (Add lines 22, 22a, and 22b - Pay to ND State Tax Commissioner)

22c

23 If line 21 is greater than line 20, enter difference less line 22b, as OVERPAYMENT

(LV) 23

(Enter $0 if less than $5)

a. Amount of line 23 to be credited to 2014 estimated tax (Minimum $5)

(AI) 23a

b. Amount of line 23 to be REFUNDED (Subtract line 23a from line 23) (No refund under $5)

23b

I declare under the penalties of North Dakota Century Code § 12.1-11-02, which provides for a Class A misdemeanor for making a false statement in a

governmental matter, that this return, including any accompanying schedules and statements, has been examined by me and to the best of my knowledge

and belief is a true, correct, and complete return.

I authorize the

Date:

North Dakota

Signature of Officer:

Title:

Office of State

Tax Commissioner

®

Date:

Signature of Preparer:

FEIN:

Address:

to discuss this

tax return with

Mail to: Office of State Tax Commissioner, 600 E. Boulevard Ave., Dept. 127, Bismarck,

the preparer.

North Dakota 58505-0599

PLEASE DO NOT WRITE IN THIS SPACE

Tax Rate Table

®

$

0 to $ 25,000 . . . . . . . . . . . 1.48% of North Dakota Taxable Income

$ 25,000 to $ 50,000 . . . . $

370.00 + 3.73% of amount over $ 25,000

$ Over 50,000 . . . . . . . . . . $ 1,302.50 + 4.53% of amount over $ 50,000

CIT

"

Buy North Dakota Products"

®

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8