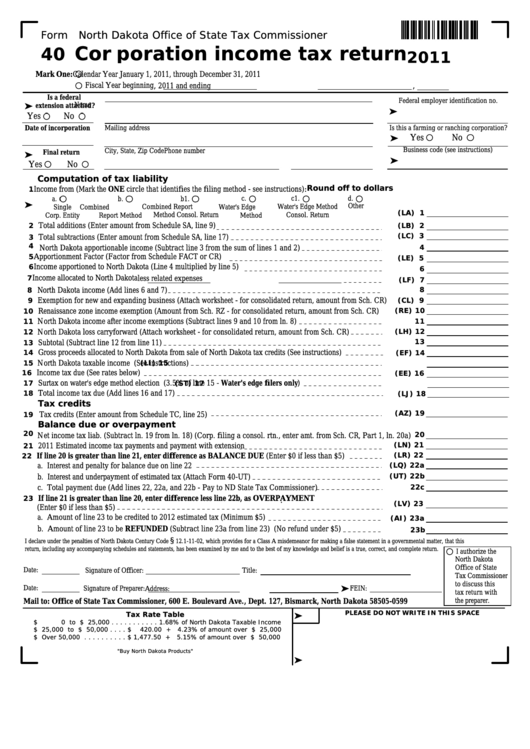

Form

North Dakota Office of State Tax Commissioner

Corporation income tax return

40

2011

Mark One:

Calendar Year January 1, 2011, through December 31, 2011

Fiscal Year beginning

,

,

2011 and ending

Is a federal

Federal employer identification no.

®

Name

extension attached?

®

Yes

No

Date of incorporation

Mailing address

Is this a farming or ranching corporation?

®

Yes

No

Business code (see instructions)

City, State, Zip Code

Phone number

®

Final return

®

Yes

No

Computation of tax liability

Round off to dollars

1

Income from (Mark the ONE circle that identifies the filing method - see instructions):

a.

b.

b1.

c.

c1.

d.

®

Other

Combined Report

Water's Edge Method

Single

Combined

Water's Edge

(LA) 1

Method Consol. Return

Consol. Return

Corp. Entity

Report Method

Method

2

(LB) 2

Total additions (Enter amount from Schedule SA, line 9)

(LC) 3

3

Total subtractions (Enter amount from Schedule SA, line 17)

4

4

North Dakota apportionable income (Subtract line 3 from the sum of lines 1 and 2)

5

(LE) 5

Apportionment Factor (Factor from Schedule FACT or CR)

6

6

Income apportioned to North Dakota (Line 4 multiplied by line 5)

7

(LF) 7

Income allocated to North Dakota

less related expenses

8

8

North Dakota income (Add lines 6 and 7)

9

(CL) 9

Exemption for new and expanding business (Attach worksheet - for consolidated return, amount from Sch. CR)

(RE) 10

10

Renaissance zone income exemption (Amount from Sch. RZ - for consolidated return, amount from Sch. CR)

11

11

North Dakota income after income exemptions (Subtract lines 9 and 10 from ln. 8)

(LH) 12

12

North Dakota loss carryforward (Attach worksheet - for consolidated return, amount from Sch. CR)

13

13

Subtotal (Subtract line 12 from line 11)

14

(EF) 14

Gross proceeds allocated to North Dakota from sale of North Dakota tax credits (See instructions)

15

(LI) 15

North Dakota taxable income (See instructions)

16

(EE) 16

Income tax due (See rates below)

17

(ST) 17

Surtax on water's edge method election (3.5% of line 15 - Water's edge filers only)

18

(LJ) 18

Total income tax due (Add lines 16 and 17)

Tax credits

(AZ) 19

19

Tax credits (Enter amount from Schedule TC, line 25)

Balance due or overpayment

20

20

Net income tax liab. (Subtract ln. 19 from ln. 18) (Corp. filing a consol. rtn., enter amt. from Sch. CR, Part 1, ln. 20a)

(LN) 21

21

2011 Estimated income tax payments and payment with extension

(LR) 22

22

If line 20 is greater than line 21, enter difference as BALANCE DUE (Enter $0 if less than $5)

(LQ) 22a

a. Interest and penalty for balance due on line 22

(UT) 22b

b. Interest and underpayment of estimated tax (Attach Form 40-UT)

22c

c. Total payment due (Add lines 22, 22a, and 22b - Pay to ND State Tax Commissioner)

23

If line 21 is greater than line 20, enter difference less line 22b, as OVERPAYMENT

.

(LV) 23

(Enter $0 if less than $5)

(AI) 23a

a. Amount of line 23 to be credited to 2012 estimated tax (Minimum $5)

23b

b. Amount of line 23 to be REFUNDED (Subtract line 23a from line 23) (No refund under $5)

§

I declare under the penalties of North Dakota Century Code

12.1-11-02, which provides for a Class A misdemeanor for making a false statement in a governmental matter, that this

return, including any accompanying schedules and statements, has been examined by me and to the best of my knowledge and belief is a true, correct, and complete return.

I authorize the

North Dakota

Office of State

Date:

Signature of Officer:

Title:

Tax Commissioner

to discuss this

®

Date:

Signature of Preparer:

FEIN:

Address:

tax return with

the preparer.

Mail to: Office of State Tax Commissioner, 600 E. Boulevard Ave., Dept. 127, Bismarck, North Dakota 58505-0599

PLEASE DO NOT WRITE IN THIS SPACE

Tax Rate Table

®

$

0 to $ 25,000 . . . . . . . . . . . 1.68% of North Dakota Taxable Income

$ 25,000 to $ 50,000 . . . . $

420.00 + 4.23% of amount over $ 25,000

$ Over 50,000 . . . . . . . . . . $ 1,477.50 + 5.15% of amount over $ 50,000

"Buy North Dakota Products"

®

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8