Page 2

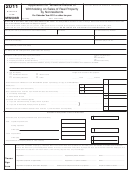

NC-1099NRS

Web-Fill

10-03

Instructions for Report of Sale of

Real Property by Nonresidents

General Information

Every individual, fiduciary, partnership, corporation or unit of government buying real property located

in North Carolina from a nonresident individual, partnership, estate or trust must complete Form

NC-1099NRS reporting the seller’s name, address, and social security or federal identification

number; the location of the property; the date of closing; and the gross sales price of the real

property and its associated tangible personal property.

Instructions to Buyer

Complete this form if you buy real property located in North Carolina from a nonresident seller (individual,

partnership, estate, or trust). Within fifteen days of the closing date of the sale, you must file this report

with the North Carolina Department of Revenue, Central Examinations Section, P.O. Box 871, Raleigh,

North Carolina 27602-0871 and furnish a copy of this form to the seller.

Information for Seller

Any gain recognized for federal income tax purposes by a nonresident from the sale of real property

and its associated personal tangible property located in this State is also subject to North Carolina

income tax; therefore, a nonresident who sells real property located in North Carolina is required to file

a North Carolina individual income tax return and pay the tax on the portion of the federal taxable

income that represents the gain from the sale of the property.

The nonresident may also be liable for payment of estimated income tax on the gain to be recognized.

You must pay North Carolina estimated income tax if you expect to owe $1,000 or more and you expect

your withholding and tax credits for the current year to be less than 90 percent of the tax on the current

year tax return, or 100 percent of the tax on the prior year return. You do not have to pay estimated

income tax if you were not required to file a North Carolina return for the previous year. Partnerships,

estates, and trusts are not required to pay estimated income tax.

Additional information for reporting a gain from the sale of real property may be obtained by calling the

North Carolina Department of Revenue at 1-877-252-3052 (toll free). Forms and instructions for filing

an income tax return and paying estimated income tax may be obtained from our website

( ) or by calling 1-877-252-3052 (toll free).

The buyer must

1. Complete and mail the original to:

North Carolina Department of Revenue,

Central Examinations Section, P. O. Box 871, Raleigh, North Carolina 27602-0871

2. Mail a copy, including instructions above, to the seller.

3. Retain a copy for your records.

1

1 2

2