Instructions For Form Ia 1120a - Iowa Corporation Income Tax Return - Short Form - 2011

ADVERTISEMENT

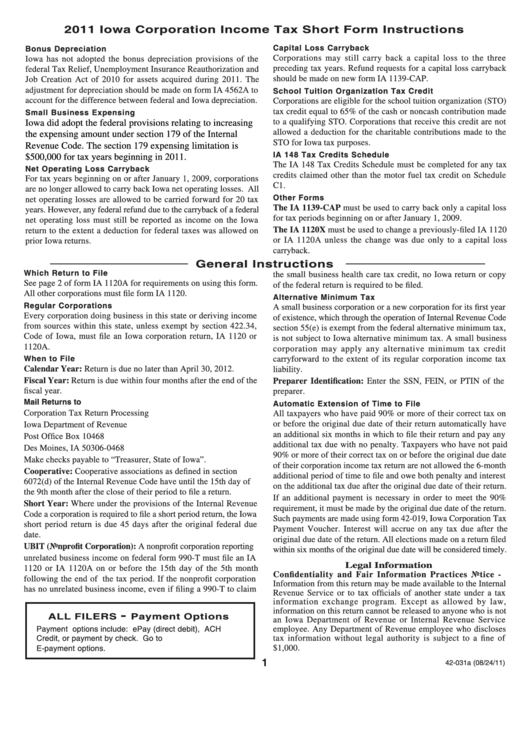

2011 Iowa Corporation Income Tax Short Form Instructions

Capital Loss Carryback

Bonus Depreciation

Corporations may still carry back a capital loss to the three

Iowa has not adopted the bonus depreciation provisions of the

preceding tax years. Refund requests for a capital loss carryback

federal Tax Relief, Unemployment Insurance Reauthorization and

should be made on new form IA 1139-CAP.

Job Creation Act of 2010 for assets acquired during 2011. The

adjustment for depreciation should be made on form IA 4562A to

School Tuition Organization Tax Credit

account for the difference between federal and Iowa depreciation.

Corporations are eligible for the school tuition organization (STO)

Small Business Expensing

tax credit equal to 65% of the cash or noncash contribution made

to a qualifying STO. Corporations that receive this credit are not

Iowa did adopt the federal provisions relating to increasing

allowed a deduction for the charitable contributions made to the

the expensing amount under section 179 of the Internal

STO for Iowa tax purposes.

Revenue Code. The section 179 expensing limitation is

IA 148 Tax Credits Schedule

$500,000 for tax years beginning in 2011.

The IA 148 Tax Credits Schedule must be completed for any tax

Net Operating Loss Carryback

credits claimed other than the motor fuel tax credit on Schedule

For tax years beginning on or after January 1, 2009, corporations

C1.

are no longer allowed to carry back Iowa net operating losses. All

Other Forms

net operating losses are allowed to be carried forward for 20 tax

The IA 1139-CAP must be used to carry back only a capital loss

years. However, any federal refund due to the carryback of a federal

for tax periods beginning on or after January 1, 2009.

net operating loss must still be reported as income on the Iowa

The IA 1120X must be used to change a previously-filed IA 1120

return to the extent a deduction for federal taxes was allowed on

or IA 1120A unless the change was due only to a capital loss

prior Iowa returns.

carryback.

General Instructions

Which Return to File

the small business health care tax credit, no Iowa return or copy

See page 2 of form IA 1120A for requirements on using this form.

of the federal return is required to be filed.

All other corporations must file form IA 1120.

Alternative Minimum Tax

Regular Corporations

A small business corporation or a new corporation for its first year

Every corporation doing business in this state or deriving income

of existence, which through the operation of Internal Revenue Code

from sources within this state, unless exempt by section 422.34,

section 55(e) is exempt from the federal alternative minimum tax,

Code of Iowa, must file an Iowa corporation return, IA 1120 or

is not subject to Iowa alternative minimum tax. A small business

1120A.

corporation may apply any alternative minimum tax credit

When to File

carryforward to the extent of its regular corporation income tax

Calendar Year: Return is due no later than April 30, 2012.

liability.

Fiscal Year: Return is due within four months after the end of the

Preparer Identification: Enter the SSN, FEIN, or PTIN of the

fiscal year.

preparer.

Mail Returns to

Automatic Extension of Time to File

Corporation Tax Return Processing

All taxpayers who have paid 90% or more of their correct tax on

or before the original due date of their return automatically have

Iowa Department of Revenue

an additional six months in which to file their return and pay any

Post Office Box 10468

additional tax due with no penalty. Taxpayers who have not paid

Des Moines, IA 50306-0468

90% or more of their correct tax on or before the original due date

Make checks payable to “Treasurer, State of Iowa”.

of their corporation income tax return are not allowed the 6-month

Cooperative: Cooperative associations as defined in section

additional period of time to file and owe both penalty and interest

6072(d) of the Internal Revenue Code have until the 15th day of

on the additional tax due after the original due date of their return.

the 9th month after the close of their period to file a return.

If an additional payment is necessary in order to meet the 90%

Short Year: Where under the provisions of the Internal Revenue

requirement, it must be made by the original due date of the return.

Code a corporation is required to file a short period return, the Iowa

Such payments are made using form 42-019, Iowa Corporation Tax

short period return is due 45 days after the original federal due

Payment Voucher. Interest will accrue on any tax due after the

date.

original due date of the return. All elections made on a return filed

UBIT (Nonprofit Corporation): A nonprofit corporation reporting

within six months of the original due date will be considered timely.

unrelated business income on federal form 990-T must file an IA

Legal Information

1120 or IA 1120A on or before the 15th day of the 5th month

Confidentiality and Fair Information Practices Notice -

following the end of the tax period. If the nonprofit corporation

Information from this return may be made available to the Internal

has no unrelated business income, even if filing a 990-T to claim

Revenue Service or to tax officials of another state under a tax

information exchange program. Except as allowed by law,

information on this return cannot be released to anyone who is not

-

ALL FILERS

Payment Options

an Iowa Department of Revenue or Internal Revenue Service

Payment options include: ePay (direct debit), ACH

employee. Any Department of Revenue employee who discloses

Credit, or payment by check. Go to for

tax information without legal authority is subject to a fine of

E-payment options.

$1,000.

1

42-031a (08/24/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3