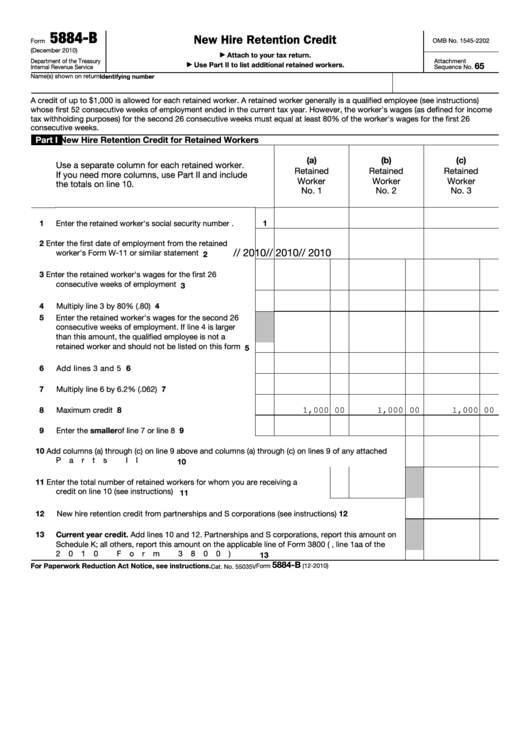

5884-B

New Hire Retention Credit

OMB No. 1545-2202

Form

(December 2010)

Attach to your tax return.

▶

Department of the Treasury

Attachment

Use Part II to list additional retained workers.

65

▶

Internal Revenue Service

Sequence No.

Name(s) shown on return

Identifying number

A credit of up to $1,000 is allowed for each retained worker. A retained worker generally is a qualified employee (see instructions)

whose first 52 consecutive weeks of employment ended in the current tax year. However, the worker's wages (as defined for income

tax withholding purposes) for the second 26 consecutive weeks must equal at least 80% of the worker's wages for the first 26

consecutive weeks.

Part I

New Hire Retention Credit for Retained Workers

(a)

(b)

(c)

Use a separate column for each retained worker.

Retained

Retained

Retained

If you need more columns, use Part II and include

Worker

Worker

Worker

the totals on line 10.

No. 1

No. 2

No. 3

1

1

Enter the retained worker's social security number

.

2

Enter the first date of employment from the retained

/

/ 2010

/

/ 2010

/

/ 2010

worker's Form W-11 or similar statement

.

.

.

.

2

3

Enter the retained worker's wages for the first 26

consecutive weeks of employment

.

.

.

.

.

.

3

4

Multiply line 3 by 80% (.80) .

.

.

.

.

.

.

.

.

4

5

Enter the retained worker's wages for the second 26

consecutive weeks of employment. If line 4 is larger

than this amount, the qualified employee is not a

retained worker and should not be listed on this form

5

6

Add lines 3 and 5 .

.

.

.

.

.

.

.

.

.

.

.

6

7

7

Multiply line 6 by 6.2% (.062)

.

.

.

.

.

.

.

.

8

Maximum credit allowable

.

.

.

.

.

.

.

.

.

8

1,000 00

1,000 00

1,000 00

9

Enter the smaller of line 7 or line 8

9

.

.

.

.

.

.

10

Add columns (a) through (c) on line 9 above and columns (a) through (c) on lines 9 of any attached

Parts II

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10

11

Enter the total number of retained workers for whom you are receiving a

credit on line 10 (see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

11

12

New hire retention credit from partnerships and S corporations (see instructions) .

.

.

.

.

.

12

13

Current year credit. Add lines 10 and 12. Partnerships and S corporations, report this amount on

Schedule K; all others, report this amount on the applicable line of Form 3800 (e.g., line 1aa of the

2010 Form 3800)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

13

5884-B

For Paperwork Reduction Act Notice, see instructions.

Form

(12-2010)

Cat. No. 55035V

1

1 2

2 3

3